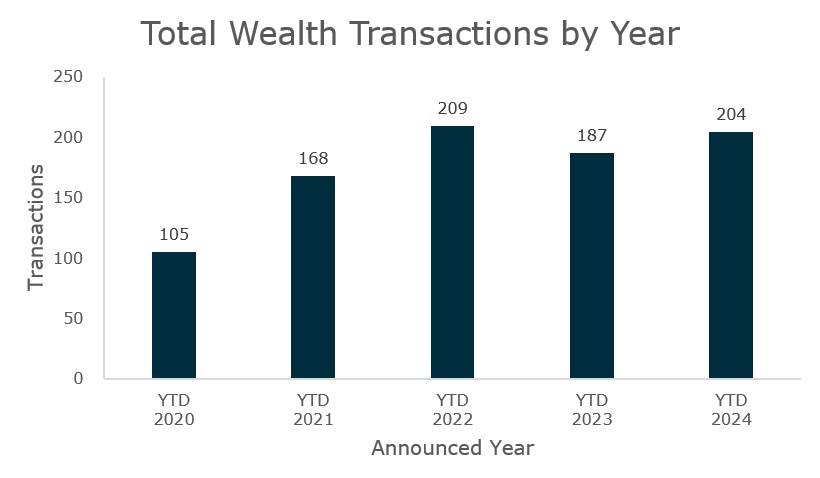

Wealth advisory merger and acquisition (M&A) activity in August was a slightly slower month with 18 announced deals, following a July that also had a relatively low number of deals with 20. Is this indicative of a larger trend? The short answer is – not necessarily. The 2024 YTD deal count is at 204 which is five deals lower than the current record year of 2022 (through August) and 17 deals higher than 2023 (through August). As of right now, 2024 is still within reach of becoming the new record year.

Whether 2024 becomes the largest year of deal activity on record or the second largest, the macro takeaway is the same. There continues to be a sustained appetite for quality firms regardless of their size. With two thirds of the year in the books and Q3 soon to be wrapping up, we’re approaching Q4, a historically significant quarter. MarshBerry remains confident about the continued deal activity throughout the rest of the year.

Source: S&P Data, Fidelity, and MarshBerry Proprietary Database. YTD: Year-to-date. Data through August 31 of each year.

The proportion of buyer types completing transactions remains steady. Private capital-backed buyers continue to lead, accounting for 70% of deals closed through August, or 142 out of 204 deals. Independent firms make up 23% of the total deals, with public firms making up the remaining 7%. Although the percentage of deals by public firms has decreased in recent years, these acquisitions are typically larger in scale. As such, public firm acquisitions should be viewed through a slightly different lens. In fact, public companies have already acquired more assets through their 15 acquisitions in 2024 than they did through their 30 acquisitions in 2023. ($121B in 2023 vs. $200B in 2024 – although $100B is attributable to the LPL/Atria Wealth Solutions deal.)

The top ten buyers now represent 33% of all announced transactions. This is a large change from back in February, when their share was nearly 50% of the total deal count. This demonstrates an evolution of greater diversification of buyer types. As of August, Focus Financial Partners, Wealth Enhancement Group, and Waverly continue to lead, accounting for nearly 14% of the 204 transactions. This increased diversity among the top buyers is positive for everyone, as it suggests there is a compelling narrative and enduring demand in the sector.

Notable transaction

On August 5, 2024, Focus Financial Partners Inc. (Focus) announced a definitive agreement for San Diego-based HoyleCohen LLC (HoyleCohen) to join Focus firm The Colony Group, LLC (Colony). This deal, set to close in the third quarter of 2024, will integrate HoyleCohen’s expertise in long-term wealth planning with Colony’s extensive planning and investment resources, and adds approximately $3.6 billion in assets under management/advisement (AUM/A). HoyleCohen, a Focus partner since 2006, aims to enhance its services and growth by partnering with Colony, while Colony will benefit from HoyleCohen’s skilled advisors and expanded West Coast presence. Both firms are aligned in their client-centric values. As a result of the deal, both firms are expecting to strengthen their ability to meet clients’ complex needs.

Looking forward

MarshBerry still remains positive about M&A activity for 2024, anticipating a potentially record-setting year as 2024 continues to go back and forth with 2022 for record YTD deal counts. What drives this optimism? The possibility of regulatory and tax changes after the presidential election, anticipated interest rate stability that could improve capital access, and the continuing issue of an aging advisor population are among the factors influencing this outlook. MarshBerry will keep a close eye on these elements and their influence on M&A activity, both this year and into the future.

Next month’s report will be a quarterly update, including a more in-depth analysis of the quarter and insight into what may transpire over the last three months of the year.