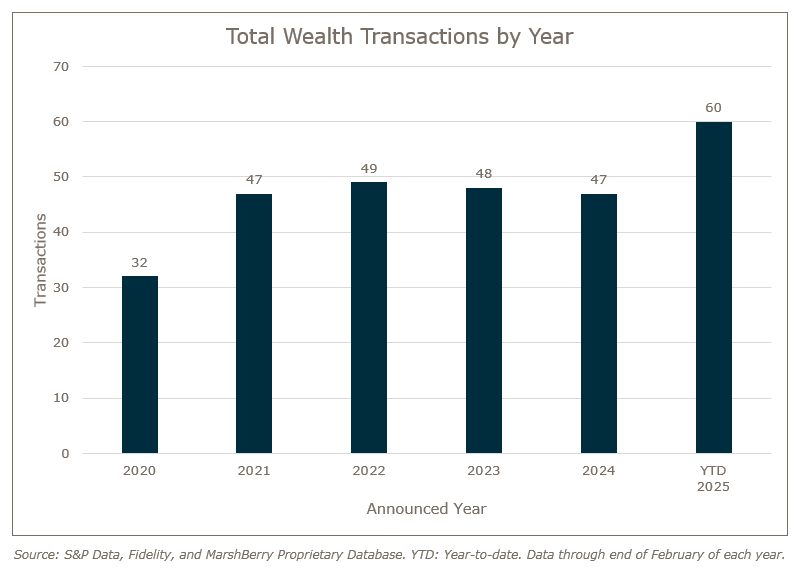

Wealth advisory merger and acquisition (M&A) activity in 2025 has made a strong showing with 60 announced transactions in the U.S. through February – 27.5% higher than last year at this time. Once again private capital-backed wealth management firms led the way. Looking at wealth M&A activity so far this year, and comparing activity to last year’s numbers, MarshBerry continues to be optimistic about 2025.

This continued acceleration in deal activity may be due, in part, to changes in leadership at the Federal Trade Commission, leading to less regulation, lower taxes, and an overall friendlier environment for M&A. In addition, February activity was driven by a relatively strong economic environment, as firms continue to seek strategic partnerships for growth, and private equity buyers aim to triple their investments within three to five years. Postponed deals from 2024 (once President Trump was re-elected) have ramped up and will most likely continue into the remainder of Q1 and perhaps even Q2.

Private capital-backed buyers accounted for 35 of the 60 transactions (58.3%) through February, a percentage that MarshBerry expects to increase as the year continues. Independent firms accounted for 17 deals and 28.3% of the market, an increase from 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired five wealth management and retirement firms in 2025 as of February.

Notable transactions:

- February 18: Mercer, a subsidiary of Marsh McLennan, has agreed to acquire SECOR Asset Management, a global investment advisory firm specializing in portfolio solutions for institutional investors. The transaction, expected to close in the second quarter of 2025 pending regulatory approvals, will bring SECOR’s $13.8 billion in assets under advisement and $21.5 billion in assets under management under Mercer’s expanding wealth management platform. SECOR, founded in 2010, provides investment advisory, fiduciary management, and asset liability solutions to pension funds, insurance companies, endowments, and family offices. Following the acquisition, SECOR’s 40 employees in New York and London will join Mercer, further strengthening its expertise in strategic investment implementation and risk management.

- February 28: Composition Wealth, newly rebranded from Miracle Mile Advisors, has acquired Vinoble Group, a Seattle-based registered investment advisor managing $630 million in assets. Founded in 2019 by a team that departed Ameriprise Financial, Vinoble now serves over 400 clients. Led by Brian Johnson, who joins Composition Wealth as a partner and wealth advisor, the acquisition enhances Composition Wealth’s expertise in group benefits consulting and tax planning. This marks one of the firm’s first deals under its new brand, contributing to its growing national presence and expanding service offerings for clients. MarshBerry advised Vinoble Group on the transaction.

Looking forward

MarshBerry is optimistic for another highly active M&A market in 2025, even a potentially record-breaking year, particularly as business-owners look to proactively plan and control their firm’s future before market circumstances control it for them. While President Trump’s tariffs could drive uncertainty in business, thus reducing acquisitions, tariffs could also create opportunities in sectors looking to sell and avoid negative financial impact. Layoffs in the federal government will increase the unemployment rate, but the continued infusion of capital from private equity firms into RIAs is bolstering confidence. MarshBerry will monitor these issues and their impact on M&A activity throughout 2025 and beyond.