The record pace of merger & acquisition (M&A) activity in the wealth advisory space is expected to continue in the final quarter of 2022. As uncertainty in the macroeconomic environment is expected to extend into the coming year, buyers are seeking more stable investments and are aggressively targeting wealth advisory firms.

Strategic partnerships in this space continue to be beneficial for both buyer and seller, as the total value from a deal can become more than just solely the sum of its parts.

Potential buyers range from private equity backed insurance brokers to publicly owned RIAs to independent wealth management firms. Many are looking to either expand their current product offerings, to increase recurring asset-based revenue, and/or to scale and diversify their geographic concentration. Over the past two years, wealth advisors have seen an increase in client investments possibly due to a rise in wages and accumulated cash during the pandemic.

Sellers, on the other hand, are seeking partners who can provide the back-office support and resources needed to allow them to focus on what they do best, advising clients, which is crucial during these uncertain times. They may also be looking to alleviate their perpetuation or succession struggles as smaller firms with aging owners look to ensure their clients and employees will be taken care of after they retire or leave. Or, conversely, some wealth firms may be seeking investments to help them grow through their own acquisitions or other consolidation opportunities.

Wealth Advisory Market Update

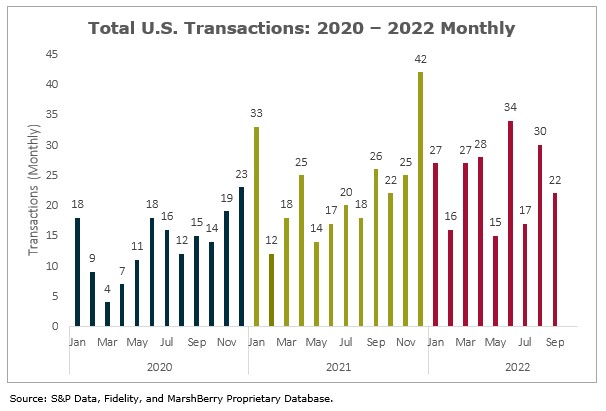

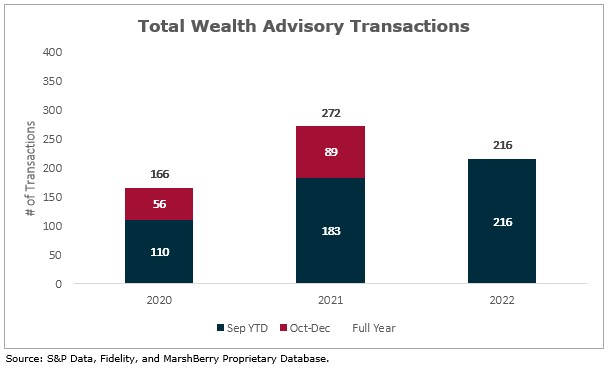

As of September 30, 2022, there have been approximately 216 announced M&A wealth advisory transactions in the U.S. this year. The current volume of deal announcements represents a 18.3% increase compared to this time last year (183 deals). The industry had a dip in September (with 22 deals), down from August (with 30 deals). The fourth quarter is a historically significant period with 32.7% and 33.7% of the total deal volume occurring in 2021 and 2020, respectively.

Private equity backed buyers, including large insurance brokers AND traditional wealth advisory firms, continue to account for most of the transactions this year and are atop the various buyer classes. This trend is expected to remain constant throughout the rest of 2022 as capital continues to be readily available and strategically deployed.

Geographically, California-based wealth advisory firms are the top targets for M&A activity and represent 13.0% of deals year-to-date in 2022. Florida and Pennsylvania firms come in at spots two and three at 7.9% and 6.9%, respectively.

Looking Forward to Q4 M&A Activity

Historically, there has been a strong increase in deal activity during the fourth quarter. The last two years saw deals in the fourth quarter represent over one-third of total deal volume for the year. As year-end approaches, the 2022 total deal count is expected to continue this trend.

There are several upcoming events that could have a potential to alter deal activity. Midterm elections are less than a month away and with no clear indication on what party will come out on top, deal volume may take a pause until the dust settles. Between OPEC+ agreeing to cut oil production and record low unemployment, the Fed is receiving increasing signals and pressure to raise rates at a substantial rate. Firms with larger amounts of relatively inexpensive capital from previously raised funds will have the competitive advantage to deploy their dry powder as the barrier of entry for new buyers increases.

Recent Wealth Advisory Acquisition

On September 30, 2022, Merit Financial Advisors (Merit), based in Alpharetta, GA, entered into a strategic partnership with Triad Financial Strategies (Triad). Triad, based in Issaquah, WA, gives Merit a strategic foothold in the Pacific Northwest. Merit is positioning themselves as an important buyer in this space as Triad becomes their eleventh acquisition since taking a minority investment in December 2020. One of their financial backers is HGGC, a middle-market private equity firm based in Palo Alto, CA, that touts former San Francisco 49ers Hall of Famer Steve Young as one of its founders. The Triad deal increased Merit’s total assets by roughly $600 million.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help expand your wealth management portfolio, please email or call John Orsini, Director, at 610.209.7273.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.