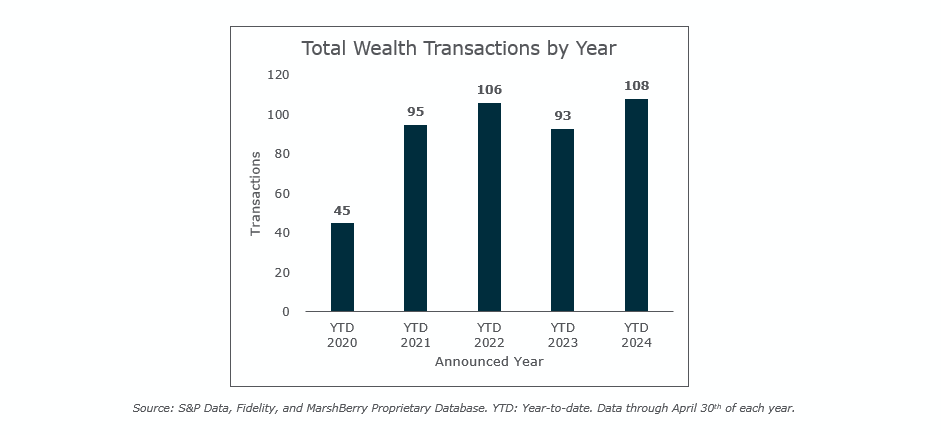

Coming off the heels of a record Q1, merger and acquisition (M&A) deal activity for wealth advisory was anticipated to take its foot off the gas pedal. But even with the slight slowdown in April, year-to-date (YTD) numbers are the highest on record. There were 22 deals reported in April, which is close to the monthly average of deal activity since 2021.

As noted in prior reports, MarshBerry has an optimistic view on deal activity for the remainder of the year. One factor that supports this thesis is that 2024 already has the highest YTD deal count with 108 deals. This is a narrow two deal lead over 2022 but represents a 15-deal lead over 2023. With a third of the year wrapped up, it appears that 2024 will likely give 2022 a run for its money.

The trend in buyer types remains consistent, with private capital-backed buyers continuing to dominate the market, representing 76% of the 108 transactions through April. Independent firms accounted for 19% of total deals, while public firms accounted for the remaining 5%.

Diversification of buyers is widening. This is noted by the top ten buyers accounting for 36% of all announced transactions, while in February this number was almost 50%. The top three (Focus Financial Partners, Waverly, and Diversified Advisor Network) account for nearly 14% of the 108 total transactions. Buyer diversity is a positive indicator of the market’s appetite.

Notable transaction

- April 1: Clearstead Advisors, LLC (Clearstead), based in Cleveland, OH, has acquired Wilbanks Smith and Thomas Asset Management, LLC (WST) of Norfolk, VA. WST was founded in 1990 and had 45 employes with approximately $5 billion of assets under advisement (AUA). The transaction expands Clearstead’s reach into the Mid-Atlantic and Southern states and increases Clearstead’s total AUA to approximately $44 billion. WST’s advisory business will be rebranded as Clearstead Advisory Solutions, operating as a division of Clearstead Advisors, LLC. Wayne Wilbanks, WST’s founder, will continue to lead the division, leveraging Clearstead’s family office planning capabilities and alternative investments platform to benefit clients. Clearstead, who has been backed by Flexpoint Ford since 2022, aims to enhance client service through M&A, solidifying its position as one of the leading registered investment advisors in the U.S.

Looking forward

Four months into the year and MarshBerry remains optimistic about the potential for 2024 being a record-breaking year. This optimism is fueled by strong YTD transaction data and various economic factors, including the upcoming presidential election with potential regime changes, expected stabilization of interest rates, and the ever-aging population of advisors. MarshBerry remains vigilant in monitoring these factors and their influence on M&A activity this year and in the years to come.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230