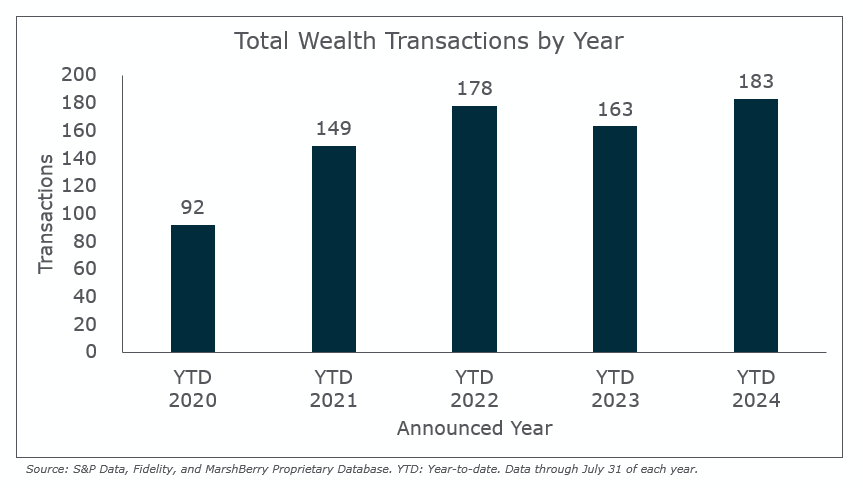

July was a comparatively vanilla month with 19 announced wealth advisory merger and acquisition (M&A) deals, which is normal for a month that follows a quarter end. So how does this affect year-to-date deal count? Well, with the inclusion of deals that relate to prior months that were announced after the fact – the 2024 YTD deal count increased to 183. This is five deals higher than 2022 (the current record year) and 20 deals higher than 2023, an increase of ~3% and 12%, respectively.

With a narrow lead over 2022, this year continues to display a sustained deal appetite and is on pace to become the largest year of deal activity on record. Through seven months and with Q4 quickly approaching, which is a historically significant quarter, MarshBerry remains optimistic about deal activity for the rest of the year.

There is a consistent ratio of buyer types that are completing transactions. Maintaining their dominance is private capital-backed buyers who represent 73% of deals closed through July, or 134 of the total 183 deals. Independent firms represent 20% of total deals, which was their same percentage for the entire year in 2023. While deal activity (as a percentage of total deals) by public firms has been on the decline over the past few years, often times their acquisitions are larger in size. In fact, public companies have already acquired more assets through their 10 acquisitions in 2024 than they did through their 30 acquisitions in 2023. ($121B in 2023 vs. $187B in 2024 – although $100B is chalked up to the LPL/Atria Wealth Solutions deal.)

The top ten buyers now account for 35% of all announced transactions. Looking back at February where this number was nearly 50%, the current trend is demonstrating more diversification. Wealth Enhancement Group, Focus Financial Partners, and Waverly, the top three buyers through July, make up nearly 15% of the total 183 transactions. Diversity in the top buyers is good for all parties. It indicates longevity of the space via a strong and sustained demand.

Notable transactions:

On July 18, 2024, Bluespring Wealth Partners (“Bluespring”), announced the acquisition of Shelton Financial Group (“Shelton”), based in Fort Wayne, Indiana. Shelton, which has been around for 25 years and manages nearly $500 million in assets, has transitioned its investment operations to Kestra Financial (“Kestra”), Bluespring’s wealth management platform. Shelton is known for its multi-generational legacy planning and faith-based investment philosophy. Shelton will continue under the leadership of President Jeff Shelton and his team. Bluespring Chairman Stuart Silverman and Kestra Financial President Stephen Langlois expressed their enthusiasm for Shelton’s integration into Kestra, highlighting the added value and collaborative opportunities within its ecosystem.

Looking forward

What’s on the horizon? While the Democratic presidential nominee has changed, concerns about potential tax implications have not. MarshBerry remains optimistic about M&A activity in 2024, with the potential for a record-breaking year driven by strong transaction data to date, the potential for regime changes due to the upcoming presidential election, expected stability in interest rates that could enhance capital accessibility, and the ever-present aging advisor population. MarshBerry will continue to closely track these elements and their effects on M&A activity, both this year and moving forward.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.