Despite continued macroeconomic headwinds of inflation, stock market volatility and increasing cost of capital – merger & acquisition (M&A) activity in the wealth advisory space is expected to continue at a record pace through the end of 2022.

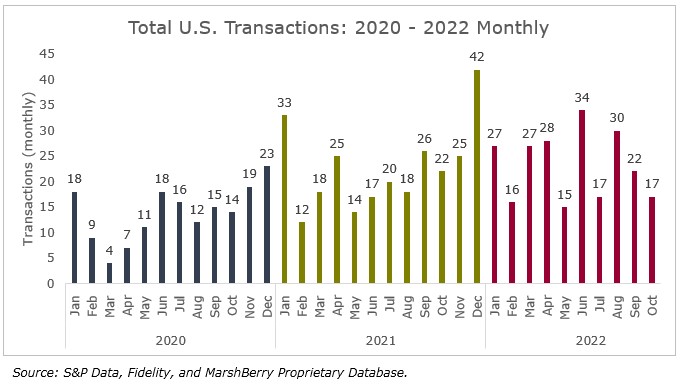

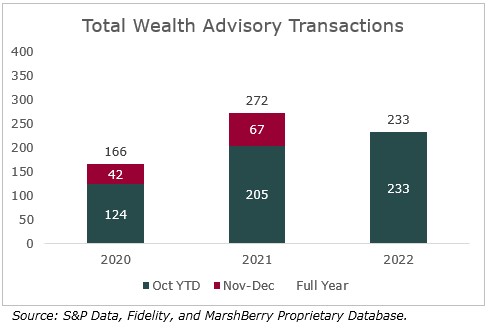

Through October, there have been approximately 233 announced wealth M&A transactions in the U.S., compared to 205 deals through the same time period last year. While October saw a slight dip in total deals with only 17, the current deal volume represents a 13.6% increase compared to this time last year. For the last two years, deals in the fourth quarter represented over one-third of the total deal volume for the year.

Who is Buying Wealth Advisory Firms?

Potential buyers and partners in this space range from private equity (PE) backed firms to publicly owned registered investment advisors (RIAs) to independent wealth management firms. They are seeking more stable investments and are aggressively targeting wealth and retirement planning firms. The most active acquirers have invested heavily in services and capabilities to make their firms more attractive to advisors and their clients. Now, they seek to recruit advisors to their platform so that they can scale these investments.

PE backed buyers include traditional wealth advisory firms as well as large insurance brokers and represent the largest percentage of deals in 2022. Through October, there have been 164 wealth advisory deals transacted by PE backed buyers or 70.4% of the 233 total deals. It’s interesting to note that insurance brokers, many of whom are PE backed, are emerging as top acquirers. In years past, most of their activity focused on adding retirement planning capabilities to their platforms. More recently, however, it appears they are expanding into the pure play wealth advisory space – a trend that is expected to continue in the future.

Strategic partnerships

Strategic partnerships continue to be beneficial to both buyers and sellers, as they oftentimes lead to revenue and expense synergies. Sellers seek partners who can provide the back-office support and resources needed to allow them to focus on what they do best, advising clients, which is even more critical during these uncertain times. They may also be looking to alleviate their perpetuation or succession struggles as smaller firms with aging owners look to ensure their clients and employees will be taken care of after they exit the business. In other cases, business owners may seek investments from a partner to help them acquire other local business or advisors in their networks.

Deal Spotlight: Wealth Advisory M&A Transaction

October 5: Wealth Enhancement Group (WEG), an independent wealth management firm, has acquired Scroggins Wealth Management, an independent RIA with over $370 million in client assets. This is the 11th acquisition (all RIAs) made by WEG in 2022 raising their client assets under management to more than $57.7 billion. WEG continues to be a top acquirer of RIAs and has focused its inorganic growth strategy around firms with closely aligned visions in interesting geographies. In 2021, WEG received private capital backing from Onex Corporation, joining TA Associates as equal capital partners to help drive WEG’s next stage of organic growth and M&A expansion.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help expand your wealth management portfolio, please email or call John Orsini, Director, at 610.209.7273.

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA Member SIPC and an affiliate of Marsh, Berry & Company, LLC. 28601 Chagrin Boulevard, Suite 400, Woodmere, Ohio 44122 (440.354.3230)