M&A Market Update

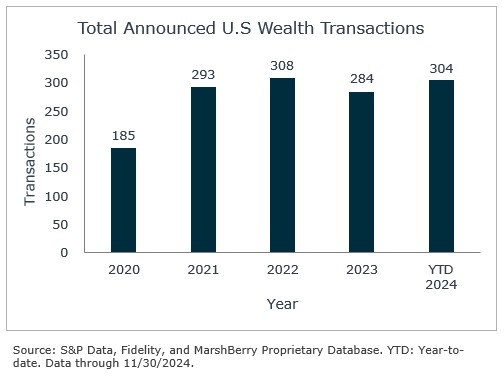

As of November 30, 2024, there have been 304 announced wealth advisory merger and acquisition (M&A) transactions in the U.S. 2024’s deal count has now surpassed 2023’s total year count (284) and is only four deals short of 2022’s record of 308 transactions. With 2024 on track to become the new record year for deals, MarshBerry’s view remains the same – there continues to be a sustained appetite for quality firms regardless of their size.

The distribution of buyer types involved in transactions has remained consistent. Private capital-backed buyers continue their hold of the majority market share by accounting for 71% of completed deals through November, or 215 out of 304 transactions. Independent firms represent 22% of deals, while public companies account for 7%. Although the share of deals by public firms has declined in recent years, these acquisitions tend to be larger in scope. Notably, in 2024, public companies have already acquired more assets through 23 transactions ($279 billion) than they did in 30 deals in 2023 ($121 billion), with $100 billion of the 2024 total attributed to the LPL/Atria Wealth Solutions deal. The main takeaway here is that even if you remove the outlier deal of the year (LPL/Atria), the 2024 assets under management (AUM) still surpasses the prior year deal by almost $60 billion.

The top ten buyers represent approximately 31% of all announced transactions through November with 93 of the 304 deals YTD. This diversity among the buyers is good for all parties and demonstrates a positive forecast on the strength of the wealth advisory M&A space which is unique to only a few industries.

Focus Financial Partners, Wealth Enhancement Group, and Waverly Advisors continue to lead the buyer pool, accounting for nearly 13% of the 304 transactions with 15, 13, and 11 deals completed, respectively.

Notable transactions:

November 1: Focus Financial Partners Inc., a leading partnership of wealth and financial services firms, announced the merger of GYL Financial Synergies, LLC, based in West Hartford, Connecticut, with The Colony Group, LLC, headquartered in Boston. GYL Financial Synergies, which joined Focus in 2016, specializes in investment management, financial planning, institutional consulting, and family office services. With the merger, GYL has added over $6.6 billion in regulatory assets under management to Colony’s client assets. This expansion brings Colony’s total number of offices across the U.S. to 100. This marks the eighth merger for Colony this year, showcasing Focus Financial Partners’ commitment to strategic growth and alignment of like-minded firms.

November 4: Aspen Standard Wealth, a firm dedicated to long-term partnerships with registered investment advisers (RIAs), has acquired Summitry, a leading RIA with $2.8 billion in assets under management. Based in the San Francisco Bay Area, Summitry provides personalized financial planning, investment strategies, and advisory services, including retirement planning, estate and trust services, and equity compensation advice. Since its founding in 2003, the firm has become a prominent name in wealth management. Aspen’s acquisition reflects its commitment to a permanent, growth-focused partnership model, distinguishing itself from traditional acquirers. This approach ensures alignment with Summitry’s client-centered philosophy and positions both firms for sustainable growth.

November 14: Mercer Global Advisors has acquired Waypoint Capital Advisors, a Minneapolis-based RIA managing nearly $1 billion in assets for ultra-high-net-worth (UHNW) individuals and families. Founded in 2015, Waypoint focuses on simplifying financial planning for generationally wealthy families, offering personalized solutions across investments, estate planning, and trusted advisor coordination. This acquisition enhances Mercer Advisors’ capabilities in serving UHNW clients by integrating Waypoint’s expertise with Mercer’s full-service wealth management platform. The partnership strengthens Mercer’s multi-family office services, reinforcing its position as a leader in delivering bespoke financial solutions to clients with complex generational wealth needs.

Looking forward

With the presidential election behind us, the topic of taxes in 2025 can be looked at with more certainty. President-elect Trump made it clear in his pre-election campaign his intention to permanently extend the policies of the Tax Cuts and Jobs Act (TCJA) of 2017, keeping capital gains taxes at current levels, or possibly even lower. While pre-election talk of possible capital gains tax increases may no longer be a concern, it shouldn’t slow deal activity for retirement and wealth advisory firms for the remainder of 2024, and into 2025 as tax changes are not the primary impetus for sellers.

What does the status quo of taxes mean for wealth and advisory firms? Overall, it’s a favorable macroeconomic climate in which interest rates are dropping (meaning favorable terms for raising dry powder), and the incoming Republican leadership is promoting stabilized taxes, lower regulations, and pro-business policies which could help boost the economy. All in all, this is expected to create tailwinds for continued revenue growth and profitability making wealth advisory firms even more desirable, helping to fuel M&A activity into 2025.

Stay tuned for MarshBerry’s 2024 year in review report expected to be published in early Q1 2025.