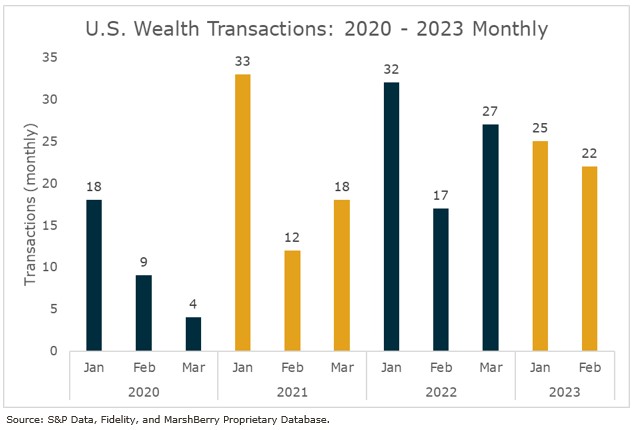

Resiliency is this month’s message in the wealth advisory mergers & acquisitions (M&A) space. February delivered 22 announced deals and kept relative pace with the 25 deals in January, for a total of 47 transactions year-to-date. Historically, deals in February suffer a post-January hangover, as January numbers usually include a carryover of deals from December that are announced late. However, this February has shown great resiliency against the typical February slump and keeps 2023 on pace with last year’s record total.

Since 2021, the first quarter has been an important catalyst towards getting the year started on the right foot. Last year, the first quarter kicked-started the record-breaking year with 76 deals. While January 2023 was down compared to 2021 and 2022 – this year delivered the best February on record. This implies a sustained appetite for retirement and wealth advisory firms.

The question is – can the momentum carry over into March? If the trend for the previous two years continues, whereas March deals exceeds February deals – perhaps we’ll see a record for the first quarter.

Deal Spotlight: Zeke Capital Advisors

February 16, 2023: Sequoia Financial Group, LLC (Sequoia), headquartered in Akron, Ohio, announced it has entered into an agreement to acquire Berwyn, Pennsylvania based Zeke Capital Advisors, LLC (Zeke). Sequoia has been the recipient of Barron’s top RIA firms for the past four years in a row. Zeke was attractive to Sequoia because of their specialization in multi-generational wealth management. Sequoia has $10 billion in asset under management (AUM) and more than 180 employees. Zeke has $5 billion in AUM and 28 employees. Zeke plans to go to market under the Sequoia Financial Group brand. The combined companies will advise on over $15 billion in client assets.

How may unfavorable economic conditions impact M&A?

As the macroeconomic news in February revealed, there continues to be concerns over high inflation, a tight labor market, recession fears and subsequent continued Federal Funds rate hikes. All of this leading to the potential higher cost of debt capital, a factor that directly influences M&A activity.

While dry powder is still available, those with the need to access debt capital in order to acquire targets, are starting to become more selective in their search criteria. They are looking for firms that display a trend of higher-than-average organic growth, operate in highly desired geographies, or have capabilities that align or fill gaps that buyers are searching to fill.

While the economic landscape in February was rocky, what we may be seeing for transaction announcements in the first few months of the year is more likely tied to conversations that started back in August and September of 2022. The typical lag time for M&A deals is roughly 4-6 months from start to finish. Q1 may be the recipient of those finalized deals.

Outlook for 2023

The momentum for investment in the wealth advisory space has been building over the past few years. And despite the higher cost of debt capital and recent market volatility, demand continues to outpace supply with over 40 private equity buyers actively pursuing acquisition strategies. 2022 showed this by delivering a record number of deals during a down financial market and less-than-optimal capital raise environment.

We remain cautiously optimistic and are encouraged by these early signs in 2023, but we will continue to watch and listen to the market and provide insights as the year progresses.

If you have questions about Today’s ViewPoint or would like to learn more about how MarshBerry can help in your wealth management strategies, please email or call John Orsini, Director, at 440.220.4116.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

MarshBerry is your trusted advisor in the wealth industry.

MarshBerry is a leading sell side advisor in the financial services industry with specialty practices in insurance and wealth management. Our advisory and consulting practices support advisors throughout their business lifecycles and include sell-side advisory, perpetuation planning, equity and debt capital raises, business and strategic planning, valuations, and industry benchmarking. Learn more about MarshBerry’s Wealth Advisory services.