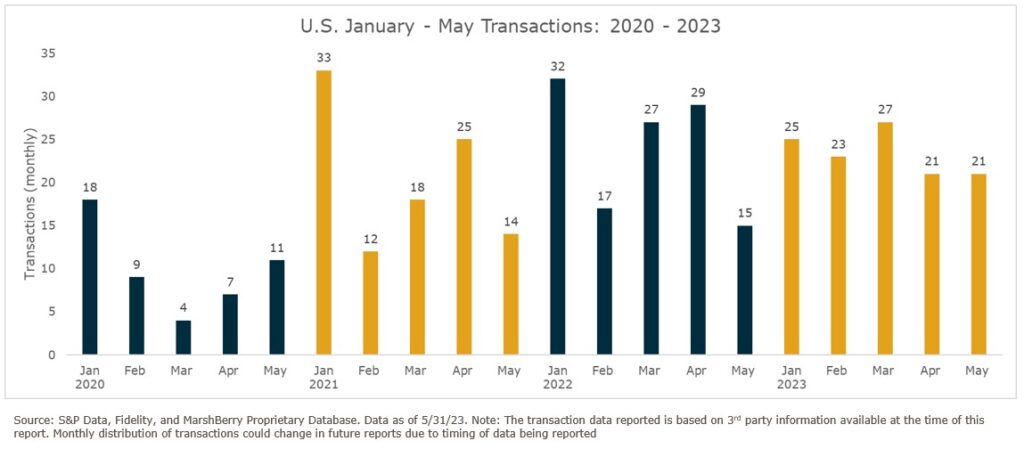

Merger & acquisition (M&A) deals for retirement and wealth advisory firms continue to surprise many with an active month of May. May traditionally trends lower with a bigger push for getting deals over the finish line in June and for the end of Q2. With 21 announced deals, and a fifth straight month of 20+ wealth deals to start the year, May brought the total deal count to 117 for 2023. This number is only three deals short of 2022’s record number of 120 announced deals through the month of May.

The big test will be June’s final count, as the 33 transactions in June 2022 represents the second highest number of wealth advisory deals in a single month (with December 2021 holding the record at 42).

Private equity-backed buyers continue expanding their presence in the marketplace and account for the majority of deals with 73 of the 117 wealth advisory transactions (62%) year-to-date (YTD) through May 2023. The private equity-backed space (PE) is still sending bullish signals with ten PE investments closed YTD May 2023, compared to six investments YTD May 2022.

Independent firms accounted for 27 of the total deals (23%) with public firms accounting for 17 deals (15%) YTD May 2023.

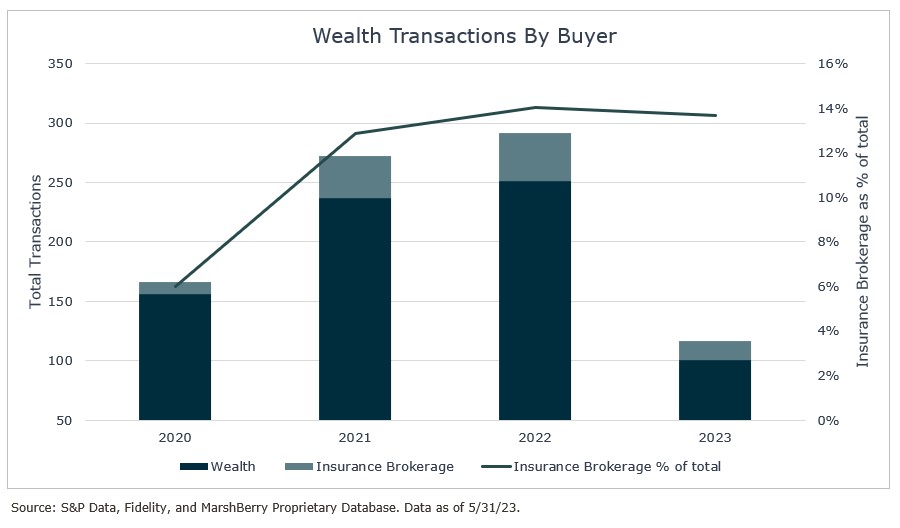

Insurance brokerages continue to target wealth advisory firms

The number of wealth advisory businesses acquired by insurance brokerage firms has been steadily rising, going from only 10 transactions in 2020 to 41 in 2022 – a 310% increase. In 2022, insurance brokerage represented 14% of the total number of deals.

Of the 117 announced deals through May 2023 – 16 were by insurance brokerage firms, or 14% of total deals, which is on pace with 2022.

Deal Spotlight: Cresset Asset Management and TRUE Capital Management Merger

May 9, 2023: Cresset Asset Management, LLC (Cresset), based out of Chicago, Illinois, announced the merger with San Francisco, California, based TRUE Capital Management (TRUE).

TRUE, founded in 2007, is a multi-family office that focuses on the sports and entertainment industries for over 350 clients. A few of their notable pro athlete clients are Robert Griffin III (NFL), Marshawn Lynch (NFL), Albert Pujols (MLB), Logan Ryan (NFL), and Richard Sherman (NFL). As of February 22, 2023, TRUE managed $1.7 billion of Assets Under Management (AUM).

Cresset is an independent, multi-family private investment firm serving the needs of high-net-worth and multi-generational families. They offer a comprehensive suite of personalized services to their clients including family office, wealth management, investment advisory and lifestyle services.

A key focus for Cresset was TRUE’s specialization in the sports and entertainment industries, as this was a vertical they looked to expand and deepen their capabilities. As a result of the merger, Cresset now has approximately $33 billion in AUM and 19 offices located around the country.

Looking forward

The excitement for investment in the wealth advisory space has been building over the past few years, and based on a strong start in 2023, looks to continue. Despite the higher cost of debt capital and recent market volatility, demand continues to outpace supply with over 40 PE buyers actively pursuing acquisition strategies.

MarshBerry remains cautiously optimistic and will continue to watch and listen to the market and provide insights as the year progresses.

If you have questions about Today’s ViewPoint, or would like to learn more about how MarshBerry can help your wealth management strategies, please email or call John Orsini, Director, at 440.220.4116.

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2022 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230