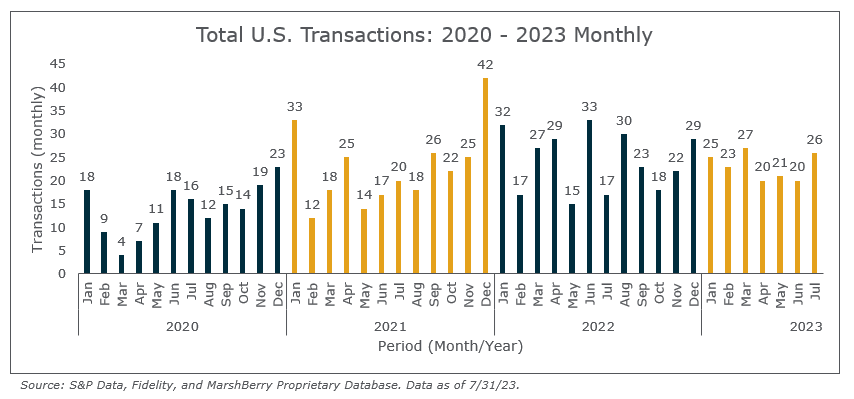

After a slightly disappointing end to Q2, with only 20 announced wealth advisory merger & acquisition (M&A) transactions in June and 61 for the quarter – July kicked off Q3 with 26 announced deals.

As of July 31, 2023, there have been 162 announced transactions, down 4.7% compared to last year but regaining some of the ground lost in June. With an average monthly deal count of 23.2, 2023 is now on track to possibly reach 278 deals. This is still short of 2022’s record 292 deals, but a strong year – despite macroeconomic conditions.

Consistency continues to be the theme for this year, with the monthly volume of transactions ranging from 20 to 27, compared to 15 to 33 last year. Acquirers appear to be responding to the macro market shifts rationally, continuing to acquire on a steady and consistent basis.

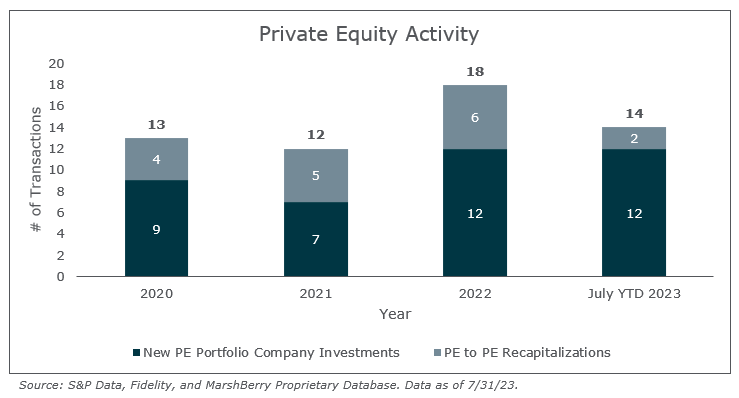

Private Equity Continues to Lead Buyer Types

Private equity-backed buyers account for most of the transactions with 108 of the 162 wealth advisory transactions (67%) in YTD July 2023. Independent firms account for 33 of the total deals (20%), with public firms making up the remainder with 21 deals (13%) YTD.

Since 2020, the number of private equity investments in wealth advisory firms has been on the rise. In 2022, 18 firms received new private equity-backed investments, up from 12 the previous year. Through July 2023, 14 firms have taken private equity capital. The majority (12) represent first-time private equity raises, while two of the transactions were private equity recapitalizations.1 If this trend continues, 2023 may hit a record for private equity investment in wealth firms.

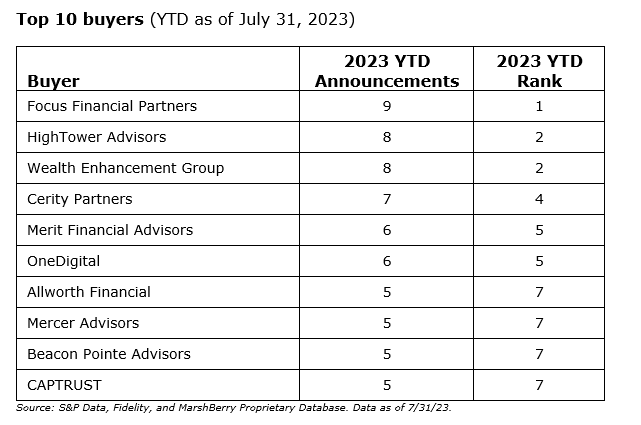

The Leaderboard

There has been a shake-up in the leaderboard with several of the historically more active acquirers taking a back seat to firms with stronger balance sheets and those focused on integration. The result is three new firms breaking through to make the top 10 buyers list through July 2023: Hightower Advisors, Cerity Partners, and CAPTRUST.

It’s not unusual to see movement in the leaderboard, particularly when comparing activity over short periods. Capital markets created challenges for some and made debt financing more expensive and less accessible for nearly all. As a result, firms are closely scrutinizing their inorganic growth strategies, looking for businesses that better align with their unique strategies and capabilities and focusing on integrating the firms previously acquired.

Deal Spotlights

Pathstone Acquires Veritable LP (7/17/23)

Pathstone, a national wealth advisory firm, announced their partnership with Newtown Square, PA-based Veritable LP (Veritable). Veritable was founded in 1986 by Michael Stolper with the vision of becoming one of the first pure multi-family offices in the United States designed to cater to the needs of ultra-high-net-worth individuals. The firm has grown significantly, with over $17 billion in assets under management (AUM) and 87 employees. As part of the integration of Veritable, Michael Stolper will become a Co-Chairman of Pathstone. The partnership helps Pathstone enter a new market and open its 18th office location. With this deal, Pathstone’s Assets Under Advisement and Administration (AUA) will exceed $100 billion.

Rothschild Acquires Sentinus (8/1/23)

Rothschild Investment Corporation (Rothschild), a 115-year-old firm based out of Chicago, IL, entered the M&A wealth advisory space with their first-ever acquisition of Oak Brook, IL-based Sentinus. Sentinus is an independent investment advisory firm with approximately $1 billion in AUM. Rothschild is expected to continue growing through acquisitions and stated they plan to acquire up to $1 billion in AUM annually.

Looking Forward

In the midst of the dog days of summer, the landscape of wealth M&A activity remains alive and well. This persistent momentum is sustained through a combination of established acquirers, well-funded entrants, and smaller players, all seeking avenues for growth and expanded market presence. Despite the challenges of higher debt capital costs, constrained supply, and market uncertainty, the M&A market continues to push through the headwinds. MarshBerry continues to be cautiously optimistic and will closely monitor the market as we progress through the second half of the year.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230