January reported great early merger and acquisition (M&A) numbers, but the news just got even better. Deal tracking sources provided some late additions to the January 2024 deal count (nine new deals) in late February that turned January 2024 into the second highest ever month of deal activity with 36 deals. It is early in the year, but 2024 is starting to feel more like 2022 and less like 2023.

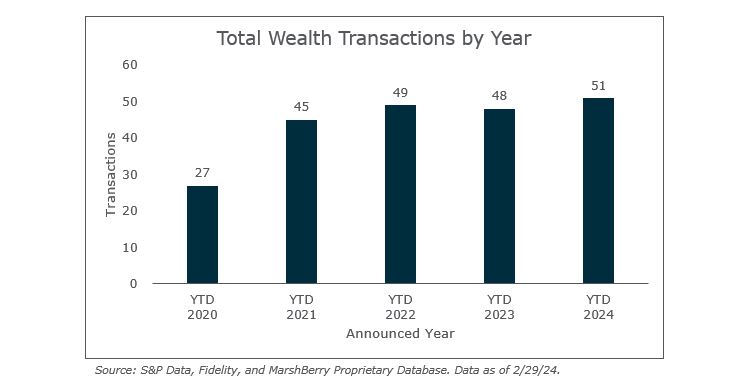

January delivered 36 announced M&A transactions in the U.S, while February brought in 15 transactions. Historically, there’s been a surge in activity in December and then a carryover into January. February tends to represent transactions started in mid-late 3Q. We tend to see a pick-up as the year goes on. An interesting point that helps support MarshBerry’s optimistic view for deal activity are year-to-date (YTD) numbers. 2024 has the highest YTD deal count with 51 deals. It is a narrow lead over 2022 (4.1%) and 2023 (6.5%), but a lead none the less. Does this mean activity is reverting to historical trends in monthly deal volume?

Private capital-backed buyers accounted for 38 of the 51 transactions (74%) through February and continue to increase their control in the space. Independent firms accounted for 11 (22%) of the total deals so far, with public firms making up the remainder with 2 (4%) deals YTD. The decreasing share of public buyer acquisitions is not worrisome as these deals tend to be larger, take more time to close, and are usually squeezed in before year-end. This percentage is expected to pick back up as the year goes on.

In concentration of buyers, ten buyers accounted for 49% of all announced transactions, while the top three (Focus Financial Partners, Summit Financial, MAI Capital Management) account for nearly ~18% of the 51 total transactions.

Notable transactions:

- February 13: LPL Financial Holdings Inc. (LPL) announced the major acquisition of Atria Wealth Solutions, Inc., (Atria), a wealth management holding company with approximately $100 billion in assets. Atria’s network includes about 2,400 advisors and 150 banks and credit unions. This is LPL’s first deal of 2024, already at 50% of last year’s total (two deals). An important point of the deal for Atria was LPL’s additional capabilities and technologies that helps Atria better service their clients and compete in the marketplace.

- February 16: Starting the year hot with two deals through February, OneDigital Investment Advisors (OneDigital), a wholly owned subsidiary of OneDigital, a prominent firm in insurance brokerage, financial services, and HR consulting, announced the strategic partnership with Chicago-based Wintrust Investments (Wintrust) to purchase Wintrust’s retirement division. Part of the rationale for the acquisition was to bolster OneDigital’s Chicagoland’s presence with Wintrust’s established market presence. At the time of the transaction’s closure, Wintrust will bring over $2.6 billion in retirement plan assets to OneDigital’s already massive $100+ billion managed assets.

Looking forward

As YTD transaction data is strong, MarshBerry is optimistic for a potentially record-breaking year in 2024. With the first two months of the year in the books, there seems to be no drop off in buyer appetite. Optimism for deal activity is supported by several economic factors: the upcoming presidential election (potential regime changes), expected interest rate stabilization which brings about less expensive capital, and the ever-increasing age of advisors. As always, MarshBerry continues to monitor these key factors and their impact on M&A activity throughout the year and beyond.

Investment banking services offered in the USA through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440)354-3230