Now that the presidential election is behind us, many of the question marks surrounding tax policies in 2025 and beyond are more in focus. President-elect Trump has made it clear in his pre-election campaign his intention to permanently extend the policies of the Tax Cuts and Jobs Act (TCJA) of 2017, keeping capital gains taxes at current levels, possibly even lower them. And now, with the possibility of Republican control of the Senate and the House, much of Trump’s plans for the TCJA may have an easier path to realization. This may temper some of the concerns over capital gains tax increases, but shouldn’t slow the momentum of merger and acquisition (M&A) activity for the remainder of 2024, and into 2025.

Additionally, the Federal Reserve’s most recent interest rates cuts (50 basis points in September and 25 basis points in November) and projections for continued cuts in 2025, should help fuel continued debt capital borrowing for investment in the insurance brokerage sector.

At MarshBerry’s recent Impact Summit, the insurance brokerage industry’s premier event on capital markets, a guest panel of industry capital lenders expressed their continued interest in lending for investments in the insurance brokerage industry. The panelists suggested they expect M&A activity to increase between 10-20% in 2025, believing the space will continue to benefit from its demonstrated resilience to market volatility, and continue to command modestly tighter spreads than many other sectors within leverage finance.

Overall, following a favorable macroeconomic climate which has seen consistent revenue growth and profitability for the insurance brokerage sector, the incoming Republican leadership – promoting stabilized or lower taxes, lower regulations, and pro-business policies – is expected to create tailwinds into 2025.

M&A Market Update

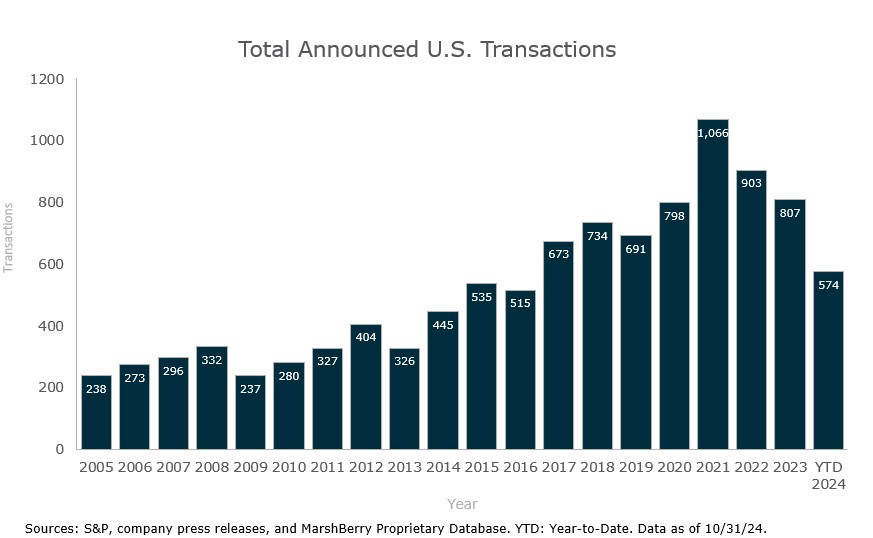

As of October 31, 2024, there have been 574 announced M&A transactions in the U.S. This activity through October is trending 5.7% higher than 2023, which saw 543 transactions announced through this time last year.

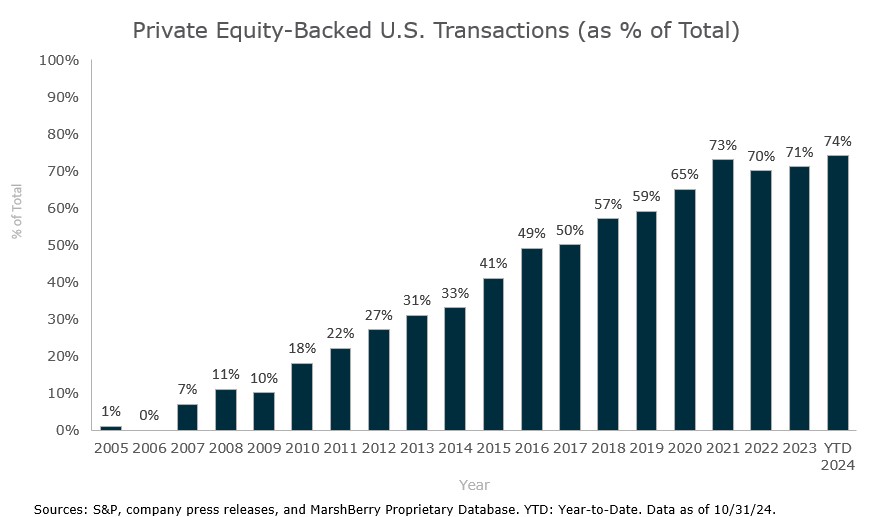

Private capital-backed buyers accounted for 422 of the 574 transactions (73.5%) through October. This represents a substantial increase since 2019 when private capital-backed buyers accounted for 59.3% of all transactions.

Independent agencies were buyers in 96 deals so far in 2024, representing 16.7% of the market, a slight increase from 2023 when independent agency acquisitions represented 15.6% of the market. Transactions in which banks were buyers continued to fall, declining from 18 transactions in 2022 to nine transactions in 2023 – an all-time low. So far in 2024, bank buyers have completed five acquisitions. Deals involving specialty distributors as targets accounted for 87 transactions, or 15.2% of the total 574 deals in 2024.

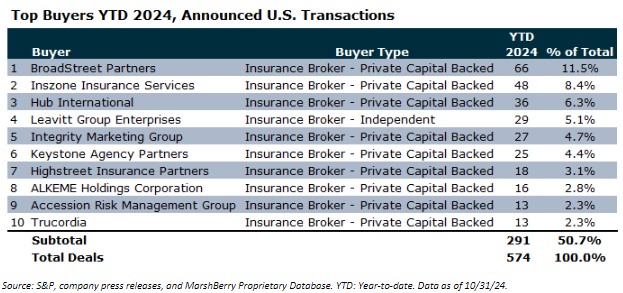

Deal activity from the top ten buyers accounted for 50.7% of all announced transactions, while the top three (BroadStreet Partners, Inszone Insurance, and Hub International) account for 26.2% of the 574 total transactions.

Notable transactions:

- October 7: AssuredPartners (AP), a prominent global insurance brokerage, has acquired CoyleKiley Insurance Agency, Inc., a Rockford, Illinois-based brokerage specializing in property and casualty, employee benefits, personal lines, and life insurance solutions. CoyleKiley, which originated as the Varland Agency in 1955 and evolved through a partnership with R.M. Coyle Company in 1992, has been under its current leadership since 2015. Post-acquisition, Dana Kiley will continue leading CoyleKiley’s operations within AP’s Great Lakes Region, overseen by Regional President Mike Ross. This acquisition aligns with AP’s strategy to strengthen its regional presence and expand client offerings. MarshBerry served as advisor to CoyleKiley in the transaction.

- October 17: Unison Risk Advisors™ (URA) has welcomed Avondale Insurance Associates as its newest partner. Avondale, founded in 2006, is URA’s fifth platform company and the first to join its non-retail division. This partnership marks URA’s 19th transaction since its inception in 2020. Avondale specializes in excess and surplus lines underwriting management, focusing exclusively on supporting wholesale distribution for the property and general liability insurance sectors. With offices in Boston, Chicago, Tampa, and New Hampshire, Avondale serves both domestic and international clients, maintaining strong capacity support from top specialty insurers in Europe, Bermuda, London, and the U.S. MarshBerry served as advisor to Avondale in the transaction.

- October 29: Arthur J. Gallagher & Co. (AJG) has acquired Adept Benefits, LLC, a health and benefits consulting firm based in Snoqualmie, Washington. This strategic move aims to enhance AJG’s benefits consulting operations in the Pacific Northwest. Adept Benefits specializes in providing health and benefits consulting services to clients in the greater Seattle area. Following the acquisition, the Adept team will continue to operate from their current location, reporting to Charlie Isaacs, head of AJG’s West region employee benefits consulting operations. MarshBerry served as advisor to Adept Benefits in the transaction.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230.

Disclosure: All deal count metrics are inclusive of completed deals with U.S. targets only. Scorecard year-to-date totals may change from month to month should an acquirer notify MarshBerry or the public of a prior acquisition. 2024 statistics are preliminary and may change in future publications. Please feel free to send any announcements to M&A@MarshBerry.com.

Source: S&P Global Market Intelligence, http://www.insurancejournal.com, http://www.businessinsurance.com/ and other publicly available sources.