As the market digs further into a hardening period, it is not enough to just hope your changes are making a difference – it is vital to understand where you stand in the marketplace and how new methods are affecting business. Many benchmarks shift during a hard market, making it harder to understand the health and vitality of your business.

Organic growth rates may be deceiving

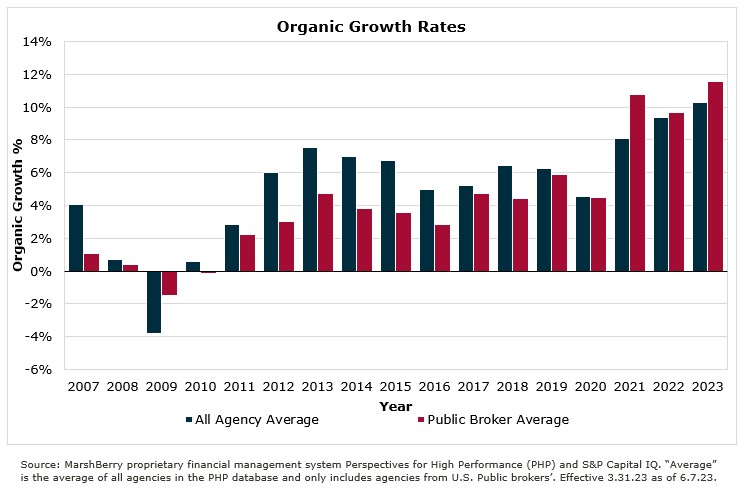

Organic growth rates, which represent revenue growth outside of acquisitions, can be a good indicator of the health and future of your firm. During a hard market where premium rates are elevated, this metric will be inflated by increased commissions; therefore, comparing organic growth rates to previous years can be deceiving. Organic growth rates must rise above that of premium rate increases to see an actual real increase in policy count, which is a better representation of new businesses and the growth of the firm. With rate increases holding steady right above 5% in 2022, any organic growth rate equal or less than that is just coasting on profits from increased premiums and not really growing. This is evident in the outsized organic growth metrics seen in 2021, 2022 and now in Q1 of 2023.

Look to metrics that more directly measure the performance of your producers

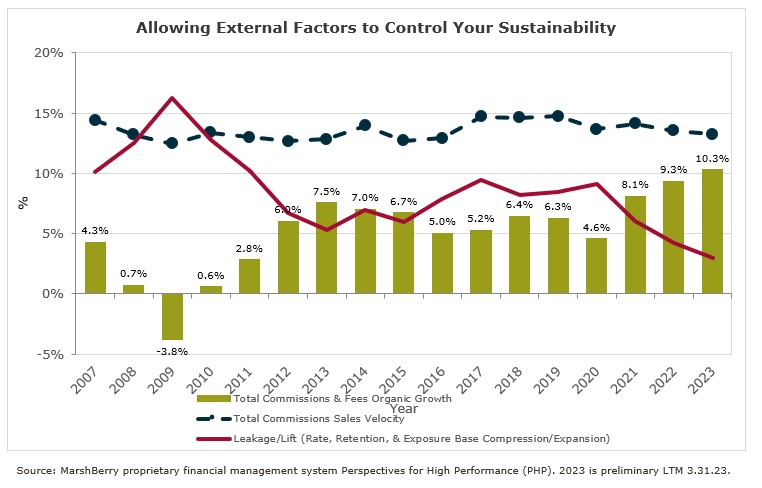

A better indication of growth and performance of producers is sales velocity, which measures the amount of new business sold compared to previous years’ commissions. This remains a more reliable metric, no matter the cycle of the market, making it a better comparison figure for sales success.

Leakage/lift is the difference between organic growth rate and new business rate. These figures explain why organic growth rates vary while sales velocity remains more constant and represent a change in revenue caused by a hard market or increase in exposures rather than new business.

Lift can occur in a hardening market or through increased exposure base and can cause an increase in revenue without a brokerage taking the initiative to grow new business. This is called lift. Typically, lift does not exceed leakage, resulting in the need for brokers to proactively sell to remain profitable.

Leakage/lift metric can provide insight for leaders on the impact of outside forces on performance metrics while sales velocity measures the effectiveness of training and sales methodology.

Take control, do not let outside forces determine your success

While it may be tempting to go along with the benefits that come along with a hard market, don’t get lazy. The market will eventually soften, rates will decrease, and firms that choose to ride the hard market wave will be left with lackluster growth and flat-footed on new business. Here are some initiatives to consider:

- Create a niche. Firms that specialize in a couple of industries report higher organic growth than generalist shops. This is due to the upgrade from being a vendor to a trusted subject matter expert advisor. Look at your top 20 accounts – where are they located, what industry will they give you referrals?

- Gain new markets. Building out a niche sometimes requires access to new markets, which is difficult to accomplish during a hard market. Consider joining an agency network that could give you access to coveted appointments that are difficult to obtain on your own.

- Create efficiencies. Get proactive with insureds before renewal windows. Provide education about a hard market and remind customers about general inflation. Let them know they should expect rate increases, and this is a widespread experience regardless of the agent. This should end the cycle of effective shopping exercises, negatively impacting marketing and servicing teams’ productivity.

If you have questions about Today’s ViewPoint, or would like to discuss how to create a growth-oriented sales plan, please email or call Brooke Lugonjic, Senior Vice President, at 616.828.0741.