The first quarter of 2025 ended on a relatively strong note for equity markets, but that momentum was quickly tested in the opening days of April. Tariff announcements from Washington sparked renewed fears around global trade, leading to a sharp sell-off across major indices during the first week of Q2. While technically outside the Q1 window, this volatility is highly relevant, as it immediately impacted sentiment across the industry and introduced fresh uncertainty into the dealmaking environment. For both buyers and sellers in the wealth advisory space, the sudden shift serves as a reminder of how quickly market conditions can change.

Even amid this volatility, demand for quality advisory firms remains high, especially from well-capitalized buyers looking to grow through acquisition. For sellers, that means real opportunities still exist. In fact, periods of market uncertainty often help clarify who the most serious and stable buyers are. At the same time, disruptions in the market can highlight the operational challenges that even the most successful independent advisors face. These moments often reinforce the value of joining a larger partner, one that can offer additional resources, infrastructure, and support to help firms not only navigate turbulence, but deliver even greater value to their clients. While market dips might affect headline AUM numbers, many buyers are increasingly focused on long-term revenue stability, client retention, and growth potential. That gives sellers a chance to highlight their operational strength, client relationships, and business model, which can still command attractive valuations even in a choppy market.

Despite these headwinds, it’s not all doom and gloom. The wealth advisory mergers and acquisitions (M&A) market has proven resilient. Deal momentum from 2024 carried into early 2025 with a strong pace of transactions, and interest in the space remains high. Private equity capital and larger wealth managers are still actively hunting for acquisitions, drawn by the long-term growth prospects of the industry. In fact, MarshBerry remains optimistic that 2025 will still be a highly active year for registered investment advisors (RIA) M&A, as one rough period in the markets isn’t enough to derail the fundamental drivers behind these deals.

M&A Market Update

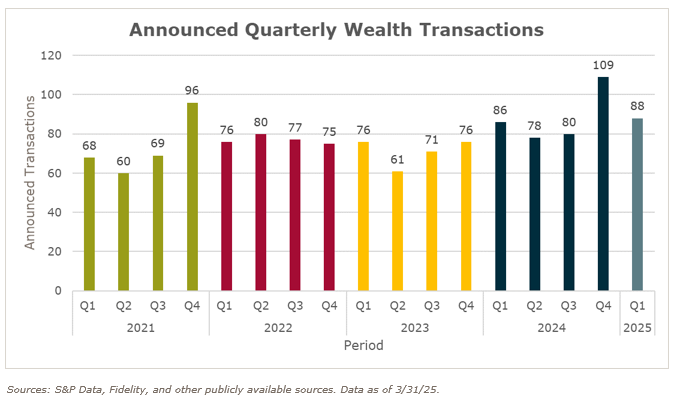

As of March 31, 2025, there were 88 announced wealth advisory M&A transactions in the U.S. This was the highest first quarter of any year on record and the third highest total quarter for any year. The 88 deals represent a 12.8% increase over the 78 deals announced in Q1 2024.

Strong M&A activity driven by both buyers and sellers

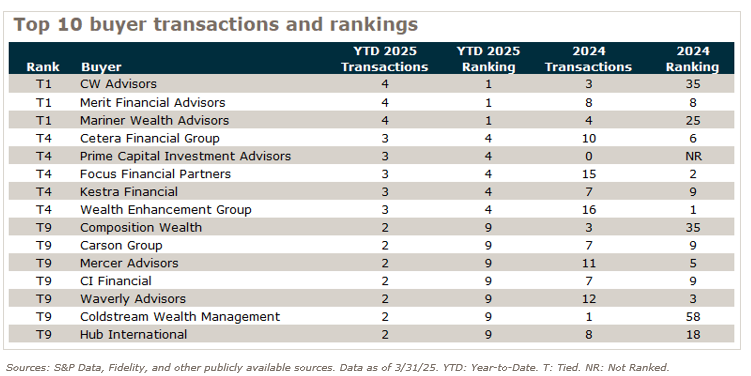

In Q1 2025, the top three buyers (CW Advisors, Merit Financial Advisors, and Mariner Wealth Advisors) accounted for 13.6% of all wealth advisory M&A transactions. The top ten buyers collectively represented 35.2% of total market activity, reflecting a strong level of engagement among active acquirers. At the same time, the data continues to show that the buyer market remains highly diverse, with a large number of firms each contributing to overall deal flow. While this snapshot highlights early momentum among some buyers, it’s important to note that it’s still early in the year. M&A activity often accelerates later in the year, and rankings can shift meaningfully as more firms enter the market or expand their acquisition strategies. The Q1 leaderboard provides an early look, but it is likely to evolve as 2025 progresses.

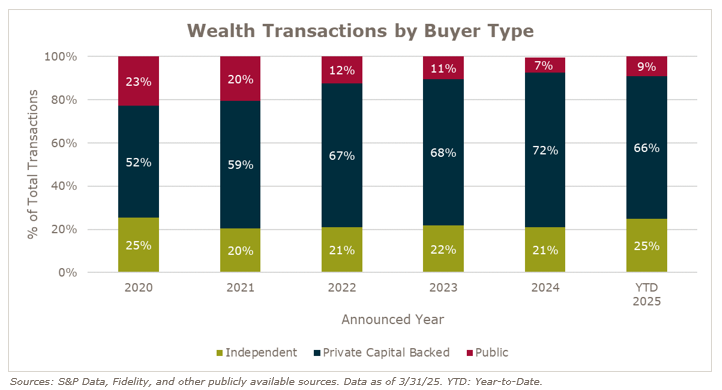

Independent and public acquirers see an uptick in activity

Public wealth managers saw a slight uptick in activity in Q1. While 2% increases may not typically be notable, this comes on the heels of four consecutive years of market share declines. Independent wealth acquirers also saw a meaningful increase in activity in Q1, growing their market share by 4%, a notable jump after several years of relatively flat share. What’s particularly interesting is that this movement wasn’t driven by a handful of serial buyers, but rather by a wide base of firms stepping in for the first time. In total, 21 independent firms made acquisitions this quarter with 20 of them completing one deal each, and only one, Coldstream Wealth Management, completing two. This dispersion of activity suggests a growing comfort with M&A as a growth lever among independent firms, many of which are entering the market without institutional capital. It’s a strong reminder that private equity isn’t the only path to deal-making.

While still driving the majority of activity in the market, private capital-backed wealth acquirers recorded a small decrease as a percentage of total deal counts in Q1 2025, representing 66% of all announced deals, compared to 72% in 2024. From 2020 to 2024, PE backed wealth managers increased their market share every year, so it remains to be seen if this upward trend will continue in 2025.

Retirement industry M&A update

There were 12 announced retirement transactions in Q1, already encompassing 50% of last year’s total. In recent years, retirement-focused advisory firms were most often acquired by insurance brokerages, drawn to the natural synergy between retirement planning and annuity or insurance product distribution. But that trend is shifting. Increasingly, these firms are being acquired by wealth-focused platforms instead. One reason is that more wealth firms are now building robust retirement income and decumulation planning capabilities to serve aging client bases, making these acquisitions highly strategic. Additionally, retirement-focused firms bring deep, trust-based client relationships and sticky AUM—characteristics that align well with the recurring revenue, high-retention models that wealth buyers increasingly prioritize. As wealth firms look to expand their service offerings and deepen client wallet share, acquiring retirement-centric practices has become a natural extension of their growth strategy.

Insurance brokerage insights

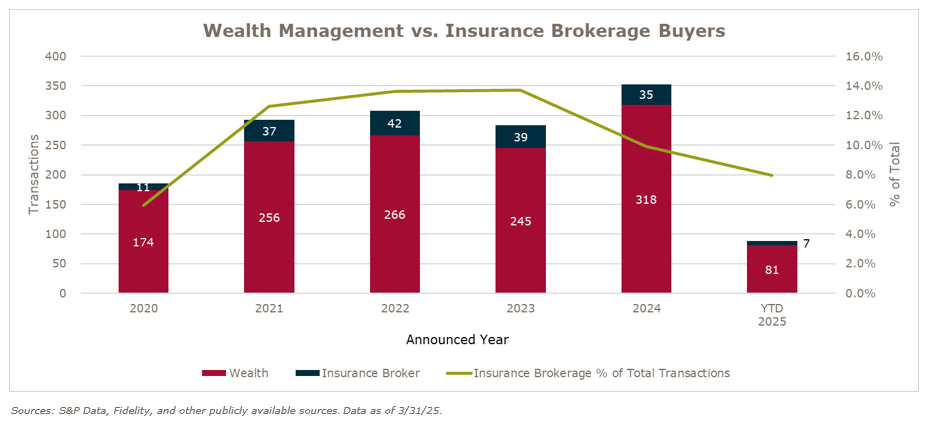

Transactions in which insurance brokerages were buyers has seen a slight dip in 2025, with these transactions representing 8.0% of the market. This percentage of insurance brokerage activity has consistently been between 10% to 14% since 2021. This decrease may signal a shift in the strategic priorities of insurance brokerages, as they adapt to changing market conditions. However, with strong fundamentals in the industry, it remains to be seen whether this trend will persist or rebound in the near future.

Notable Transactions

January 24: Wealth Enhancement acquired VanceGray Wealth Management, Inc., a Maine-based registered investment advisor with offices in Bangor and Ellsworth, managing over $409 million in client assets. Led by President Vance Gray, Jr., the firm specializes in personalized financial planning for retirees, small business owners, and individuals seeking long-term growth. This acquisition, which closed on December 31, 2024, marks Wealth Enhancement’s first entry into Maine and its 22nd transaction of the year. The deal enhances Wealth Enhancement’s Northeast presence and supports its ongoing strategy to expand through partnerships with client-focused advisory teams. MarshBerry represented VanceGray in this transaction.

March 3: Composition Wealth acquired Vinoble Group, a Seattle-based registered investment advisor managing $630 million in client assets. This marks one of the firm’s first acquisitions under its new brand, following its rebrand from Miracle Mile Advisors. Founded in 2016, Vinoble Group is led by Brian Johnson and a 15-person team, all of whom will join Composition Wealth, with Johnson becoming a partner and wealth advisor. The firm offers comprehensive wealth management, group benefits consulting, and tax planning, and expanded its capabilities through local mergers in 2020. MarshBerry represented the Vinoble Group on this transaction.

March 31: Wealth Enhancement acquired the Wealth Services Division of First International Bank & Trust, adding over $581 million in client assets to its platform and marking its entry into North Dakota. The acquired team will join Wealth Enhancement Trust Services, LLC, which has been part of the firm’s offerings since 2021. The division brings expertise in trust and estate planning, as well as investment, mineral, and farmland management, serving clients across multiple states. This strategic acquisition expands Wealth Enhancement’s national footprint to 34 states and enhances its ability to deliver comprehensive wealth management and trust services to multi-generational clients. MarshBerry represented First International Bank & Trust in this transaction.

What does the rest of 2025 have in store?

Despite the late-quarter dip in the markets, the outlook for wealth advisory M&A remains overwhelmingly positive. The first quarter of 2025 was the strongest Q1 on record, and all signs point to that momentum continuing. The drivers of consolidation—rising demand for scale, advisor succession, and the strategic advantages of platform affiliation—are only intensifying. Buyers remain well-capitalized and eager to grow, and today’s market presents an opportunity for firm owners to capitalize on still-strong valuations, differentiate themselves, and secure long-term growth. While uncertainty may linger, the momentum we’ve seen so far suggests meaningful opportunity ahead. With the right positioning, firms could turn 2025 into a year of significant progress.