The first article of MarshBerry’s series on leveraging peer insights shared popular solutions to talent and staffing challenges. Another topic that is steadily rising among insurance firm executives is strategies for getting more efficiency from staff. The overall consensus by brokers is that their business needs to determine if there are any competitive enhancements they can use, such as potentially leveraging technology, AI and peer insights, to drive improvements in both service and operations.

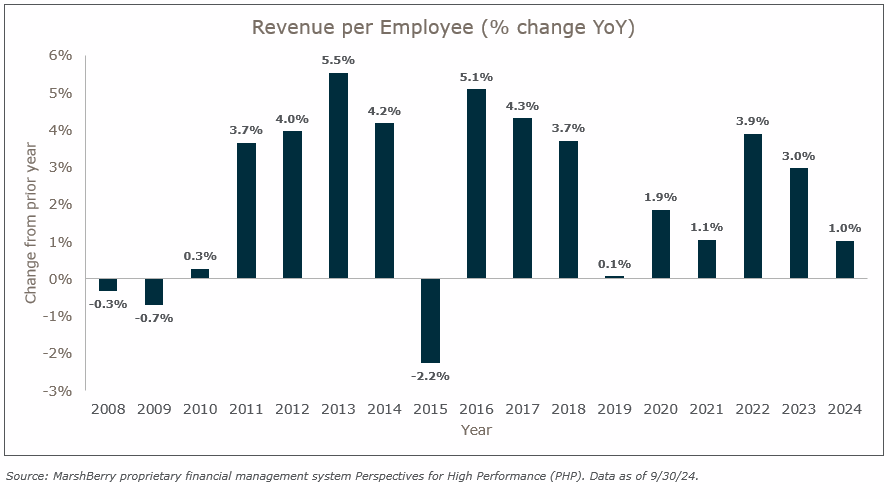

Because of this, many insurance brokerage firms are starting to work smarter, not harder. This is evident in efficiency metrics such as revenue per employee. In fact, as indicated in the chart below, revenue per employee continues to increase every year since 2015 (as a percentage year-over-year). While rate lift from the recent hard market may positively contribute toward this incline, MarshBerry consultants are also having more conversations with clients around other initiatives that resulted in increased staff efficiency and productivity.

How are they doing it? Here are three potential insights for improving employee efficiencies gleaned from MarshBerry Connect’s peer exchange

1. Embrace outsourcing to streamline functions

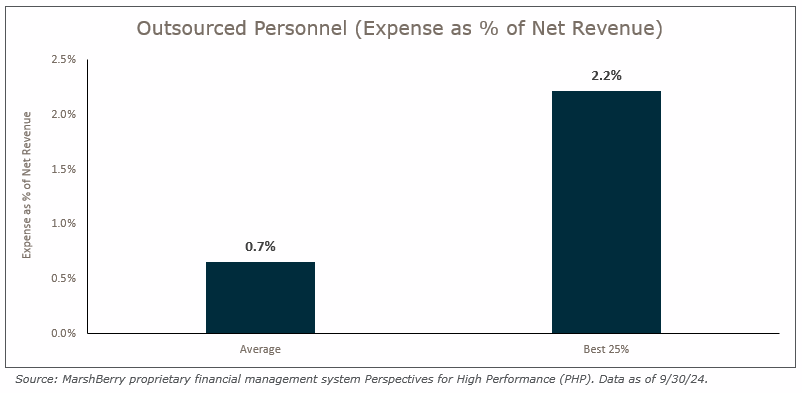

More and more firms are reporting that they are outsourcing certain functions to increase employee efficiencies and drive better results. According to MarshBerry’s proprietary financial management system Perspectives for High Performance (PHP) the top performing 25% of firms (or “Best 25%” of firms based on organic growth rates) are outsourcing 2.2% of their employees, compared to the average firm who only outsources 0.7% of their staff.

Brokers are outsourcing functions like payroll and basic accounting. Others use virtual assistants to set up systems for sending out motor vehicle records or certificates of insurance. Remember that clients rarely interact with these functions, so using a virtual assistant at a fraction of the price can increase accuracy and efficiency without sacrificing client expectations

2. Simplify operational needs with technology

Using technology and/or AI solutions can increase accuracy and reduce errors and omissions. Specific ways firms are using tech include:

- AI solutions designed to automate and process insurance documents.

- Digital services that handle manual tasks and cover back-office support.

- AI agents (not to be confused with insurance agents) that can integrate with email systems, optimize team schedules, or take meeting minutes.

- Programs that help create org charts to plan for future staffing needs.

Other commonly used tech solutions include tools to help with cybersecurity and fraud management, inventory support, and customer service.

3. Capture essential knowledge from tenured employees

Training and development can also get a boost from tech. Brokerage firms are finding that AI can capture knowledge from senior producers or other experienced personnel before they retire or leave the company. There are programs that can capture information, then create tutorials, instructions, or standard operating procedures for new hires. Even things like client insights or sales best practices can be documented for greener producers or under-performers. This approach can also save time for those busy professionals who may have previously been tasked with training new hires. Firms can have a small amount of on-site instruction blended with independent learning opportunities. Most importantly it creates a repository of priceless knowledge that can be referenced for years to come.

Solutions like these can help create efficiencies across many functions, freeing up staff to do more meaningful client relationship business. But testing and learning can be timely and costly. Instead, lean on a network who’s already done the troubleshooting and knows what works and what doesn’t. That’s one of the biggest benefits of a peer exchange network – it’s like your own personal research group.

To get more details on these anecdotes, check out the replay of MarshBerry’s FocalPoint Leveraging Peer Insights for Accelerated Growth.