Economists have long monitored the market for U.S. Treasury notes as an indication of the overall health of the U.S. economy. In a typical economy, the longer the term of the U.S. Treasury note, the higher the interest rate, or yield, that it pays to the note holder, and vice versa.

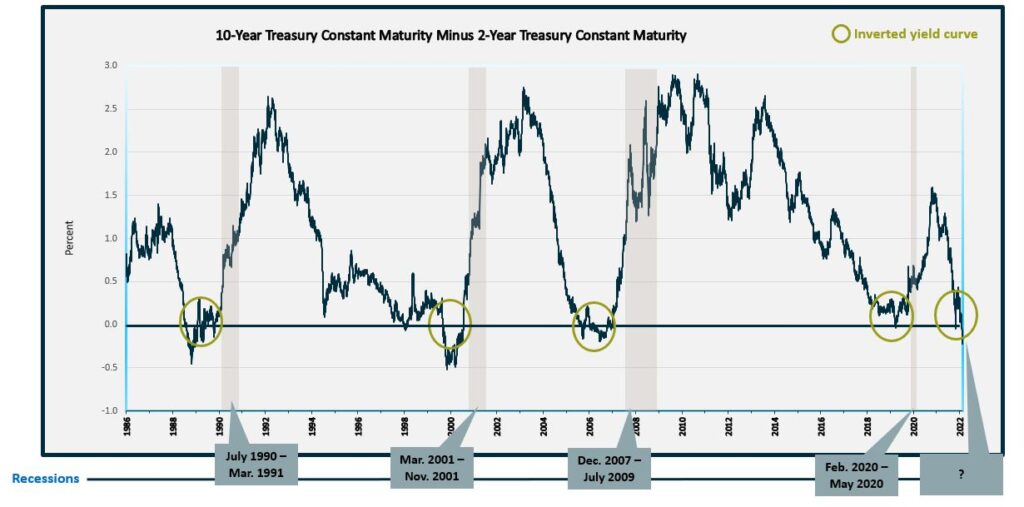

But what happens when the yield on the longer 10-year Treasury note is less than the yield on the shorter two-year Treasury note? You get what economists call an “yield curve inversion.”

The reasons a two-year note yield would exceed that of its 10-year counterpart has mostly to do with a lack of consumer confidence in long-term investments due to rising inflation, rising interest rates and an expectation of an overall sluggish economy. In short, investors become doubtful that the return on a 10-year note would be better than the return on a shorter-term note.

Recession Indicators

Recessions are most often declared once we are well into one, starting to emerge from one, or even after one has ended. (Remember the 2020 recession? Technically, it lasted three months.) But that doesn’t keep economists and financial journalists from trying to predict when one might be nearly upon us.

Possible signs of a recession include negative gross domestic product growth, a high employment rate, rising interest rates, or short-term U.S. Treasury notes returning higher yields than long-term notes – a.k.a. the yield curve inversion.

Of all recession indicators, the inverted yield curve is one of the most historically accurate. Almost every recession over the past 60 years has been preceded by an inverted yield curve. (The exception is 1966, where the inverted yield curve only preceded an economic slowdown, but not an official recession.) The most recent three-month recession of 2020 was preceded by a brief yield curve inversion.

The latest yield curve inversion

Most recently, the yield difference between the 10- and two-year Treasury notes dropped below zero on April 1, 2022, bounced back up a few days later, but dipped below zero again on July 6, 2022, and continues to be inverted.

The cause of the inversion was investors’ reaction to June’s Consumer Price Index delivering a 9.1% year-over-year increase of inflation and the subsequent interest rate hike by the Federal Reserve (Fed).

Keep in mind, the gap between short- and long-term bond rates (the yield curve inversion) doesn’t cause a recession. It’s simply a reaction to other economic factors (i.e., rising inflation and increased interest rates) that make investors just jittery enough to take an action (i.e., buying short-term bonds) that exhibits their feelings about investment risks.

Is all of this pointing towards a recession? Maybe. How long will a recession last and what the impact will be are harder to predict and may be dependent on how the Fed reacts to get the economy back on track. Currently, the Fed is trying to control inflation by slowing down the economy with interest rate hikes (0.25% in March, 0.50% in May, 0.75% in June, and 0.75% in July). While it is not the Fed’s intention to induce a recession, a recession is a very natural consequence of such interest rates hikes.

The Impact of a Potential Recession on the Insurance Industry

The impact of higher rates will start to affect everyone – individuals and businesses. For the insurance industry, while historically resilient during recessions, it’s still important to understand how your firm might be affected. Here are four things you should consider:

- During a recession, insurance carriers may see slower revenue expansion as business investment decreases and asset prices soften.

- Insurers with long-tail liabilities or longer settlement periods may see more impact on their results, given that they will be paying for claims that may not be settled until after policy expiration. With lower long-term rates, these insurers may have less investment income from long-term securities to pay for claims. Furthermore, given inflationary pressures, claims may become more expensive when paid further out in the future.

- Carriers may experience lower returns from their investment portfolios in slowdowns compared to higher growth periods.

- Insurers tend to invest more of their portfolio in fixed income investments. Because of increasing inflation currently, insurers could risk income from bond investments falling short in comparison to the rising costs. Given the risk of higher volatility to asset portfolios, insurers may want to look at methods to boost underwriting margins.

So, while a recession hasn’t been officially declared, nor has the impact of the Fed’s moves been fully felt, insurance agencies, brokerages and carriers may want to consider doing some advanced scenario planning and assess how they will maneuver through potential volatility and macroeconomic changes.

If you have questions about Today’s ViewPoint or would like to learn more about how market activity may impact your firm, email or call Brian Ambrosia, Director, at 440.220.5430.

Source: Federal Reserve Bank of St. Louis – 7/26/22

Investment banking services offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230

Thought Leadership Events

At a MarshBerry event, the outcomes are just as important as the experience. Attendees leave with the most advanced data, cutting-edge insights, new relationships, and key takeaways that will help them innovate their businesses. Join other insurance agencies and brokerage executives, along with MarshBerry advisors, at a MarshBerry event to explore strategies that will help you lead your firm to growth and profitability and learn how to maximize value.