The first quarter of 2025 ended on a relatively strong note for equity markets, but that momentum was quickly tested in the opening days of April. Tariff announcements from Washington sparked renewed fears around global trade, leading to a sharp sell-off across major indices during the first week of Q2. While technically outside the Q1 window, this volatility is highly relevant, as it immediately impacted sentiment across the industry and introduced fresh uncertainty into the dealmaking environment. For both buyers and sellers in the wealth advisory space, the sudden shift serves as a reminder of how quickly market conditions can change.

Even amid this volatility, demand for quality advisory firms remains high, especially from well-capitalized buyers looking to grow through acquisition. For sellers, that means real opportunities still exist. In fact, periods of market uncertainty often help clarify who the most serious and stable buyers are. At the same time, disruptions in the market can highlight the operational challenges that even the most successful independent advisors face. These moments often reinforce the value of joining a larger partner, one that can offer additional resources, infrastructure, and support to help firms not only navigate turbulence, but deliver even greater value to their clients. While market dips might affect headline AUM numbers, many buyers are increasingly focused on long-term revenue stability, client retention, and growth potential. That gives sellers a chance to highlight their operational strength, client relationships, and business model, which can still command attractive valuations even in a choppy market.

Despite these headwinds, it’s not all doom and gloom. The wealth advisory mergers and acquisitions (M&A) market has proven resilient. Deal momentum from 2024 carried into early 2025 with a strong pace of transactions, and interest in the space remains high. Private equity capital and larger wealth managers are still actively hunting for acquisitions, drawn by the long-term growth prospects of the industry. In fact, MarshBerry remains optimistic that 2025 will still be a highly active year for registered investment advisors (RIA) M&A, as one rough period in the markets isn’t enough to derail the fundamental drivers behind these deals.

M&A Market Update

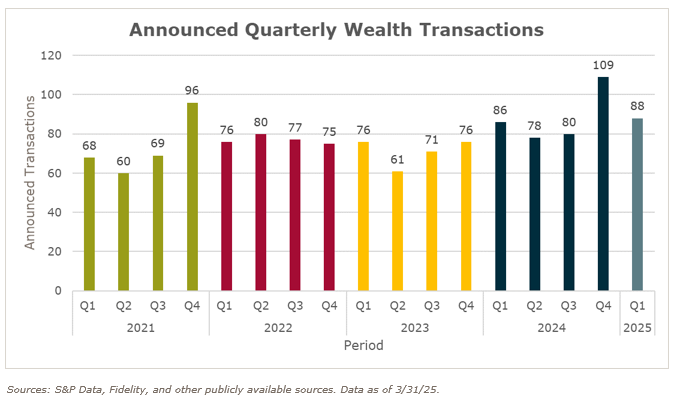

As of March 31, 2025, there were 88 announced wealth advisory M&A transactions in the U.S. This was the highest first quarter of any year on record and the third highest total quarter for any year. The 88 deals represent a 12.8% increase over the 78 deals announced in Q1 2024.

Strong M&A activity driven by both buyers and sellers

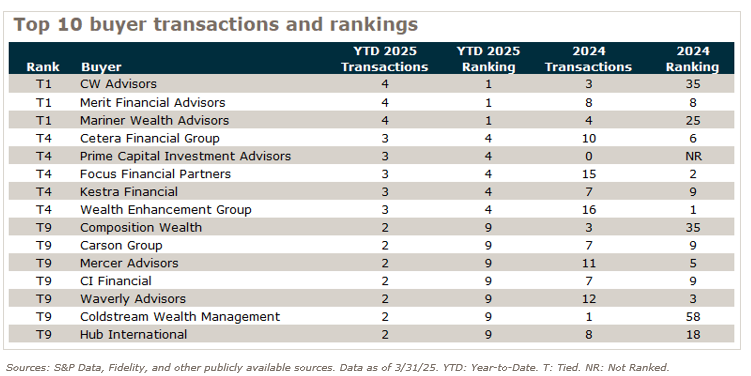

In Q1 2025, the top three buyers (CW Advisors, Merit Financial Advisors, and Mariner Wealth Advisors) accounted for 13.6% of all wealth advisory M&A transactions. The top ten buyers collectively represented 35.2% of total market activity, reflecting a strong level of engagement among active acquirers. At the same time, the data continues to show that the buyer market remains highly diverse, with a large number of firms each contributing to overall deal flow. While this snapshot highlights early momentum among some buyers, it’s important to note that it’s still early in the year. M&A activity often accelerates later in the year, and rankings can shift meaningfully as more firms enter the market or expand their acquisition strategies. The Q1 leaderboard provides an early look, but it is likely to evolve as 2025 progresses.

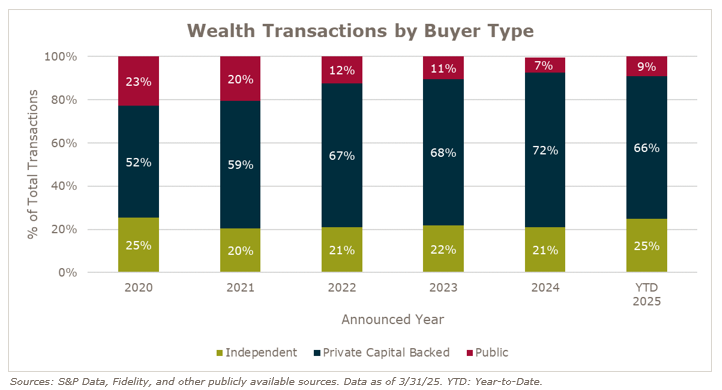

Independent and public acquirers see an uptick in activity

Public wealth managers saw a slight uptick in activity in Q1. While 2% increases may not typically be notable, this comes on the heels of four consecutive years of market share declines. Independent wealth acquirers also saw a meaningful increase in activity in Q1, growing their market share by 4%, a notable jump after several years of relatively flat share. What’s particularly interesting is that this movement wasn’t driven by a handful of serial buyers, but rather by a wide base of firms stepping in for the first time. In total, 21 independent firms made acquisitions this quarter with 20 of them completing one deal each, and only one, Coldstream Wealth Management, completing two. This dispersion of activity suggests a growing comfort with M&A as a growth lever among independent firms, many of which are entering the market without institutional capital. It’s a strong reminder that private equity isn’t the only path to deal-making.

While still driving the majority of activity in the market, private capital-backed wealth acquirers recorded a small decrease as a percentage of total deal counts in Q1 2025, representing 66% of all announced deals, compared to 72% in 2024. From 2020 to 2024, PE backed wealth managers increased their market share every year, so it remains to be seen if this upward trend will continue in 2025.

Retirement industry M&A update

There were 12 announced retirement transactions in Q1, already encompassing 50% of last year’s total. In recent years, retirement-focused advisory firms were most often acquired by insurance brokerages, drawn to the natural synergy between retirement planning and annuity or insurance product distribution. But that trend is shifting. Increasingly, these firms are being acquired by wealth-focused platforms instead. One reason is that more wealth firms are now building robust retirement income and decumulation planning capabilities to serve aging client bases, making these acquisitions highly strategic. Additionally, retirement-focused firms bring deep, trust-based client relationships and sticky AUM—characteristics that align well with the recurring revenue, high-retention models that wealth buyers increasingly prioritize. As wealth firms look to expand their service offerings and deepen client wallet share, acquiring retirement-centric practices has become a natural extension of their growth strategy.

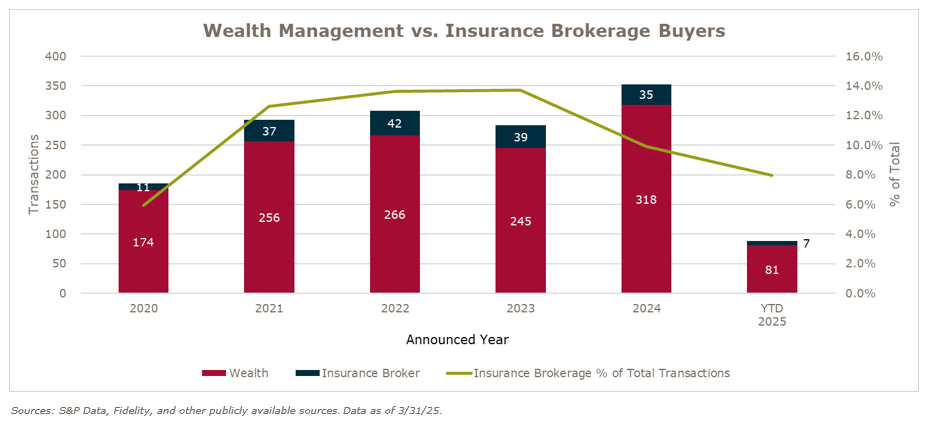

Insurance brokerage insights

Transactions in which insurance brokerages were buyers has seen a slight dip in 2025, with these transactions representing 8.0% of the market. This percentage of insurance brokerage activity has consistently been between 10% to 14% since 2021. This decrease may signal a shift in the strategic priorities of insurance brokerages, as they adapt to changing market conditions. However, with strong fundamentals in the industry, it remains to be seen whether this trend will persist or rebound in the near future.

Notable Transactions

January 24: Wealth Enhancement acquired VanceGray Wealth Management, Inc., a Maine-based registered investment advisor with offices in Bangor and Ellsworth, managing over $409 million in client assets. Led by President Vance Gray, Jr., the firm specializes in personalized financial planning for retirees, small business owners, and individuals seeking long-term growth. This acquisition, which closed on December 31, 2024, marks Wealth Enhancement’s first entry into Maine and its 22nd transaction of the year. The deal enhances Wealth Enhancement’s Northeast presence and supports its ongoing strategy to expand through partnerships with client-focused advisory teams. MarshBerry represented VanceGray in this transaction.

March 3: Composition Wealth acquired Vinoble Group, a Seattle-based registered investment advisor managing $630 million in client assets. This marks one of the firm’s first acquisitions under its new brand, following its rebrand from Miracle Mile Advisors. Founded in 2016, Vinoble Group is led by Brian Johnson and a 15-person team, all of whom will join Composition Wealth, with Johnson becoming a partner and wealth advisor. The firm offers comprehensive wealth management, group benefits consulting, and tax planning, and expanded its capabilities through local mergers in 2020. MarshBerry represented the Vinoble Group on this transaction.

March 31: Wealth Enhancement acquired the Wealth Services Division of First International Bank & Trust, adding over $581 million in client assets to its platform and marking its entry into North Dakota. The acquired team will join Wealth Enhancement Trust Services, LLC, which has been part of the firm’s offerings since 2021. The division brings expertise in trust and estate planning, as well as investment, mineral, and farmland management, serving clients across multiple states. This strategic acquisition expands Wealth Enhancement’s national footprint to 34 states and enhances its ability to deliver comprehensive wealth management and trust services to multi-generational clients. MarshBerry represented First International Bank & Trust in this transaction.

What does the rest of 2025 have in store?

Despite the late-quarter dip in the markets, the outlook for wealth advisory M&A remains overwhelmingly positive. The first quarter of 2025 was the strongest Q1 on record, and all signs point to that momentum continuing. The drivers of consolidation—rising demand for scale, advisor succession, and the strategic advantages of platform affiliation—are only intensifying. Buyers remain well-capitalized and eager to grow, and today’s market presents an opportunity for firm owners to capitalize on still-strong valuations, differentiate themselves, and secure long-term growth. While uncertainty may linger, the momentum we’ve seen so far suggests meaningful opportunity ahead. With the right positioning, firms could turn 2025 into a year of significant progress.

The wealth management industry has never been more attractive to investors. Record valuations, rising merger and acquisition (M&A) activity, and a flood of capital from private equity and strategic buyers have created an opportunity for advisory firm owners. Many leaders who have spent years building sustainable, client-centric businesses are now facing the billion-dollar question: Should I double down and scale or capitalize on my firm’s enterprise value and sell?

It’s not just a financial decision. It’s a defining moment in the legacy of a business.

As an organization deeply involved in helping advisory firms navigate growth, succession, and liquidity strategies, MarshBerry frequently works with founders and executives who are grappling with this exact dilemma. The decision is rarely black and white and shouldn’t be driven by market momentum alone. Instead, it requires a deep understanding of ownership’s long-term vision, appetite for growth, and the shifting dynamics of the wealth management industry. What follows is a roadmap for thinking through this complex decision strategically.

Valuations are tempting — but what comes next?

We’re in an era of strong valuations. Many advisory firms, particularly those with $1B+ in assets under management (AUM), are seeing enterprise values between 10x–20x+ EBITDA (earnings before interest, taxes, depreciation and amortization), depending on their growth trajectory, revenue profile, talent mix and other value drivers. The influx of institutional capital has reshaped deal structures, offering everything from all-cash exits to minority recapitalizations that allow founders to take chips off the table while staying in control.

But valuations alone shouldn’t drive your decision. The real question is: What’s the best use of your time, capital, and energy over the next decade? Let’s consider this key question from two perspectives.

Conviction, capital, and culture-building (The case for growth)

If you believe in the long-term value of your firm and have the appetite for further expansion, now could be the time to lean in rather than exit. Here’s why:

- The market remains ripe for growth. Client demographics, wealth transfers, and the demand for holistic planning are fueling the need for sophisticated advisory firms. If you’ve built a scalable model, there’s significant opportunity to scale it ahead.

- Differentiated firms can stand out. Many private equity-backed aggregators are realizing that integrating multiple firms together takes time and energy. That presents opportunities for independently minded firms to stand out with a differentiated, client-first model.

- Minority transactions can offer liquidity. Instead of a full exit, consider selling a minority stake to a strategic or capital partner. This de-risks your personal financial position while maintaining leadership over your firm’s future.

- Internal succession still holds merit. If your vision is to create an enduring enterprise, a well-structured internal succession plan can provide long-term stability without handing over the keys to an outside buyer.

That said, growth requires conviction, capital, and culture-building at scale. If you’re not willing to reinvest in your team, technology, and client experience, it may be time to consider the alternative.

Being proactive beats being reactive (The case for cashing in)

Selling is often the smartest way to protect the value you’ve worked so hard to build. Here’s when cashing in might make sense:

- You desire centralized infrastructure. Running a billion-dollar firm is no small task. If managing infrastructure, technology, and processes is eating into the time you’d rather spend with clients, selling could allow you to refocus on what you love most.

- You’ve built an institutional-ready firm. If you have strong financials, a scalable operating model, and a leadership team that can carry the firm forward, buyers will pay a premium for that level of maturity.

- You want to deliver more value to clients. Selling isn’t just about the valuation, it’s about unlocking new possibilities. The right partner might give you the resources and bandwidth to enhance your services, adopt cutting-edge technology, or expand offerings that provide even greater value to your clients.

- You recognize the opportunity to build on your success. Growing a business comes with evolving challenges: scaling operations, retaining top talent, and meeting shifting client expectations. Selling may allow you to both achieve strong valuations and better navigate your business’ future.

The key is ensuring you are proactively evaluating options before external pressures (like a market downturn or internal leadership gaps) force your hand.

How to navigate the decision: Five key questions to ask

Before deciding whether to grow or sell, take a step back and ask yourself these crucial questions:

- What’s my personal and professional horizon? Do I see myself leading this firm for another 5, 10, or 15 years? If not, what’s my ideal role in the future?

- What’s my appetite to grow? Am I comfortable reinvesting in the business, or would I rather lock in my gains now?

- What would a great outcome look like? Beyond the financials, what legacy do I want to leave behind?

- Am I prepared for the complexity of scaling? Do I have the right team, capital, and infrastructure to grow beyond where we are today?

- What are my deal structure options? If I were to sell, would I prefer a full exit, a minority transaction, or a partnership that allows me to stay engaged?

The power of intentionality

The best advisory firm leaders don’t react to market trends, they architect their future with intention. Whether you choose to grow or cash in, the key is making a proactive, strategic decision that aligns with your long-term vision.

For those leaning toward growth, the path forward requires investment, leadership development, and a commitment to scaling intelligently. For those considering a sale, maximizing value requires the right deal structure, the right buyer, and a clear post-sale plan.

Either way, don’t let the current M&A market dictate your decision. The best time to evaluate your options is before the market forces your hand. The right strategy isn’t just about today’s valuation, it’s about building a future that aligns with what matters most to you.

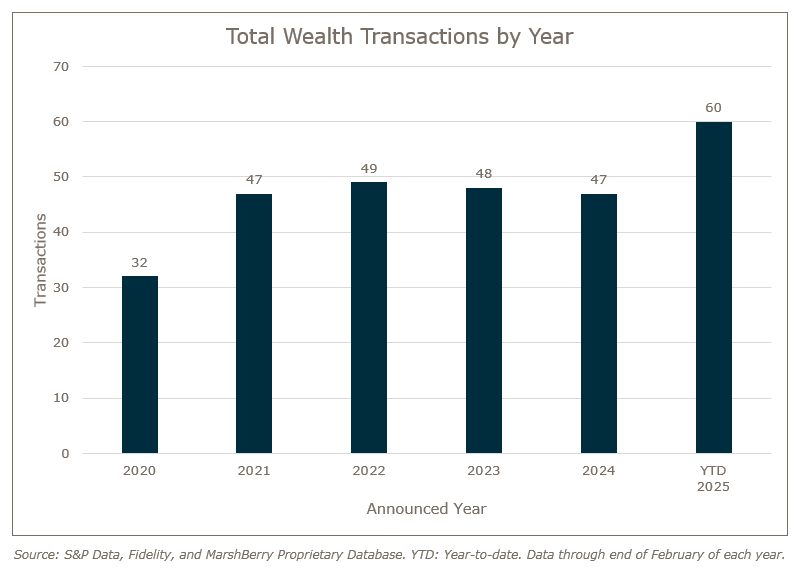

Wealth advisory merger and acquisition (M&A) activity in 2025 has made a strong showing with 60 announced transactions in the U.S. through February – 27.5% higher than last year at this time. Once again private capital-backed wealth management firms led the way. Looking at wealth M&A activity so far this year, and comparing activity to last year’s numbers, MarshBerry continues to be optimistic about 2025.

This continued acceleration in deal activity may be due, in part, to changes in leadership at the Federal Trade Commission, leading to less regulation, lower taxes, and an overall friendlier environment for M&A. In addition, February activity was driven by a relatively strong economic environment, as firms continue to seek strategic partnerships for growth, and private equity buyers aim to triple their investments within three to five years. Postponed deals from 2024 (once President Trump was re-elected) have ramped up and will most likely continue into the remainder of Q1 and perhaps even Q2.

Private capital-backed buyers accounted for 35 of the 60 transactions (58.3%) through February, a percentage that MarshBerry expects to increase as the year continues. Independent firms accounted for 17 deals and 28.3% of the market, an increase from 2024’s final percentage of 21.0% (on 76 total independent deals). Insurance brokerages have acquired five wealth management and retirement firms in 2025 as of February.

Notable transactions:

- February 18: Mercer, a subsidiary of Marsh McLennan, has agreed to acquire SECOR Asset Management, a global investment advisory firm specializing in portfolio solutions for institutional investors. The transaction, expected to close in the second quarter of 2025 pending regulatory approvals, will bring SECOR’s $13.8 billion in assets under advisement and $21.5 billion in assets under management under Mercer’s expanding wealth management platform. SECOR, founded in 2010, provides investment advisory, fiduciary management, and asset liability solutions to pension funds, insurance companies, endowments, and family offices. Following the acquisition, SECOR’s 40 employees in New York and London will join Mercer, further strengthening its expertise in strategic investment implementation and risk management.

- February 28: Composition Wealth, newly rebranded from Miracle Mile Advisors, has acquired Vinoble Group, a Seattle-based registered investment advisor managing $630 million in assets. Founded in 2019 by a team that departed Ameriprise Financial, Vinoble now serves over 400 clients. Led by Brian Johnson, who joins Composition Wealth as a partner and wealth advisor, the acquisition enhances Composition Wealth’s expertise in group benefits consulting and tax planning. This marks one of the firm’s first deals under its new brand, contributing to its growing national presence and expanding service offerings for clients. MarshBerry advised Vinoble Group on the transaction.

Looking forward

MarshBerry is optimistic for another highly active M&A market in 2025, even a potentially record-breaking year, particularly as business-owners look to proactively plan and control their firm’s future before market circumstances control it for them. While President Trump’s tariffs could drive uncertainty in business, thus reducing acquisitions, tariffs could also create opportunities in sectors looking to sell and avoid negative financial impact. Layoffs in the federal government will increase the unemployment rate, but the continued infusion of capital from private equity firms into RIAs is bolstering confidence. MarshBerry will monitor these issues and their impact on M&A activity throughout 2025 and beyond.

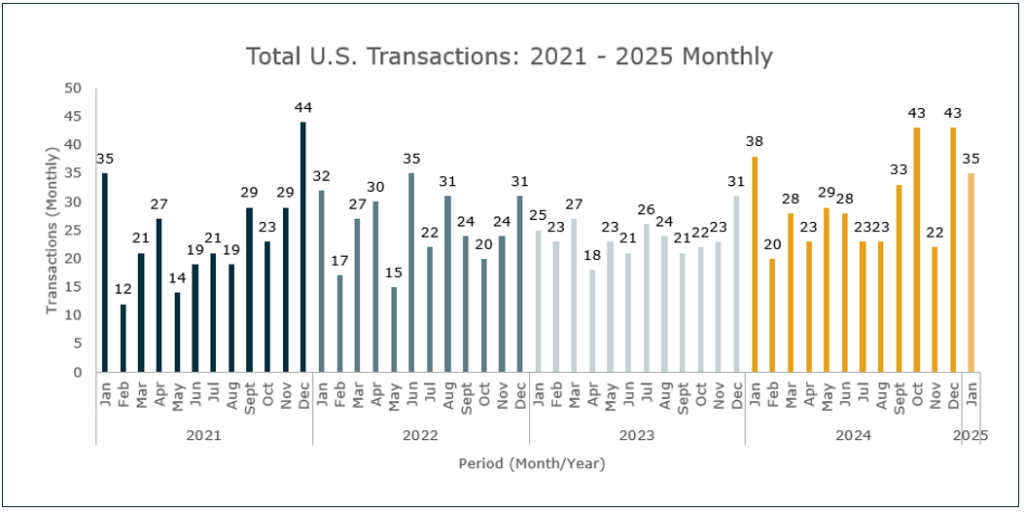

Carrying over from a strong December, January continued the momentum from 2024 and specifically Q4 2024, the biggest quarter on record. January delivered 35 announced merger and acquisition (M&A) transactions in the U.S. Once again private capital-backed wealth management firms led the way. While January 2025’s total represents a slight decrease of ~8% compared with January 2024, there are still many reasons to be optimistic about 2025.

Much of the activity of Q4 2024 was driven by an improving economic environment, firms pursuing strategic partnerships for growth, and reduced urgency to finalize deals in case of capital gains tax changes (if Democratic candidate Harris had won). Following Donald Trump’s re-election, that urgency ceased, leading to some deals being postponed to 2025 in order to delay tax payments another 12 months which is likely part of what contributed to January’s activity. There is a strong possibility that this deal delay from December will continue into the remainder of Q1 and perhaps even Q2.

Source: S&P Data, Fidelity, and MarshBerry Proprietary Database. Data as of 1/31/25.

Private capital-backed buyers accounted for 24 of the 35 transactions (69.6%) through January, representing a 14% increase since 2020 when private capital-backed buyers accounted for 55.4% of all transactions. Independent firms accounted for nine deals and 25.7% of the market, an uptick from 2024’s final percentage of 21.0% on 76 total independent deals. Insurance brokerages acquired two wealth management and retirement firms in January.

Notable transactions:

- January 15: Corient, the U.S. subsidiary of Canadian firm CI Financial, has acquired Geller & Company, a New York-based multi-family office managing $10.4 billion in assets. This acquisition bolsters Corient’s family office services, adding expertise in personal CFO services, tax compliance, estate planning, and investment management for ultra-high-net-worth clients. The deal provides Geller’s team with access to Corient’s technology, operations, compliance infrastructure, and expanded resources. Corient, a fiduciary and fee-only firm managing approximately $182 billion in assets, has been aggressively expanding in the U.S. wealth market through multiple acquisitions.

- January 29: Hub International, a Chicago-based insurance brokerage and financial services firm, has acquired Legacy Planning Partners, a Pennsylvania-based hybrid advisory affiliated with Commonwealth Financial Network. Legacy, which manages nearly $1.98 billion in client assets, consists of 12 advisors operating from offices in Horsham, Allentown, and West Chester, Pennsylvania. The team will continue utilizing Commonwealth for brokerage and advisory services. This acquisition strengthens Hub Retirement and Private Wealth, a division focused on private wealth, business owner advisory, and retirement services. Hub has been actively expanding through numerous acquisitions, with Legacy joining a platform managing approximately $172 billion in total assets. MarshBerry advised Legacy Planning Partners on the transaction.

Looking forward

With the republican administration’s focus on stabilizing or lowering taxes, reducing regulations, and implementing pro-business policies, the M&A market is expected to remain highly active in 2025. MarshBerry is optimistic for another potentially record-breaking year in 2025. January has already seen robust activity in the M&A market with several factors driving this optimistic outlook. From a buyer perspective, the expected stabilization of the rising rate environment and continued infusion of capital from private equity firms into RIAs are bolstering confidence. An aging advisor base is increasingly exploring adding strategic partners amidst uncertainty, and 2025 may be the best time to do so. MarshBerry remains vigilant in monitoring these factors and their impact on M&A activity throughout 2025 and beyond.

Consistent, organic growth is our industry’s greatest challenge, but few firms actually go through the exercise of intentionally laying out how they’ll achieve it, focusing solely on “grit and effort.” A true strategic plan isn’t just a document—it’s a blueprint for sustained growth and long-term success.

It’s not just conjecture or anecdote, but a well-documented fact: in Schwab’s 2024 RIA Benchmarking Study, 82% of Top-Performing Firms have a written strategic plan.1,2

So, where should you begin in building a strategic plan for your firm?

Begin with the End in Mind

If you’ve heard me speak, you’ve probably heard me reference Stephen Covey’s principle of ‘starting with the end in mind’ as it relates to RIA firms. The reason for this approach is simple: if you aren’t able to clearly define where you want your firm to go and what you’re building, it will be nearly impossible to make the right decisions year-over-year.

If anything, you and your team should be able to clearly define the following:

- Vision: What are you aiming to build—a local niche practice, a regional multi-office organization, a lifestyle practice or a true, growth-focused operating organization?

- Mission: What core values and standards do you want your firm to uphold? How do you want to be perceived by clients and the broader market?

- Value and Clientele: To whom are you delivering services? What segment of the market are you targeting, and what unique value can you offer them? Is there a specific niche?

Establish a Baseline and Understand Where You Are Today

Before charting a course forward, it’s essential to understand where your firm currently stands as a reference point for future comparison, but also to highlight key areas of focus for the business. In our client work, we focus on the 12 value drivers for wealth/RIA businesses, but at a minimum, the core components of this baseline assessment should include market positioning and financial health.

Market Positioning

As Jack Welch famously said, “There are only two sources of competitive advantage: the ability to learn more about our customers faster than the competition and the ability to turn that learning into action faster than the competition.” In a world with increasingly scaled competition and expanding service offerings (read: “compressing margins”), this means deeply understanding your target market and aligning your value proposition to meet their specific set of needs and address their pain points.

- Target Market: Who are you serving, and what do you provide them?

- Service Model: Does your business model allow you to profitably serve this clientele?

- Differentiators: What sets your firm apart? Is it service and quality, specialized knowledge, niche expertise, depth of service or something else?

Your positioning will have a significant impact on your organic growth potential and referral power.

Financial Health

While managing purely to maximize financials is rarely recommended, a business with a weak financial position has minimal operating leverage. Key breakdowns for financial health should include:

- Focusing on tracking growth: Focus not only on overall growth or shrinkage in fees and AUM, but where it comes from:

- Increased AUM: Existing Clients – New Assets

- Increased AUM: Existing Clients – Market Growth

- Increased AUM: New Clients

- Decreased AUM: Existing Client Withdrawals/Drawdowns

- Decreased AUM: Client Losses

- Benchmarking your firm’s performance: Benchmark against industry standards and use metrics such as:

- AUM (Assets Under Management) Growth

- Net New AUM

- New Client Growth

- Revenue Per Advisor

- EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization) Margin

- Client Retention Rates

Define Your Goals

Your plan should be a combination of long-term goals and short-term objectives (one- and three-year). As with most, we recommend SMART goals.

Examples of strategic goals might include:

- Financial Goals: Increase AUM by 15% over the next 12 months through a combination of organic growth and strategic acquisitions.

- Growth and Client Acquisition Goals: Boost new client acquisition by 50% in the next two quarters by implementing a targeted digital marketing campaign and enhancing referral programs.

- Long-Term Goals: Identify specific milestones, such as establishing an equity distribution program or establishing a human capital strategy for the organization.

Continuously Track and Refine Your Plan

A strategic plan is not static. It must evolve as your firm grows and the market changes:

- Track Alignment: Institute key performance indicators (KPIs).

- Updating the Plan: Schedule regular reviews— typically this is done annually—to reassess your strategic plan.

- Identifying Misalignment: Where does your firm’s current position diverge from your desired future state?

- Client Segmentation: Are you serving and prioritizing the right clients? Do your current clients align with your long-term goals?

- Ownership and Equity: Consider the long-term independence of your firm. Is your ownership structure conducive to developing next-generation leaders and owners, or is there a need for equity restructuring?

- Growth Targets: Are your growth goals realistic? For example, is it feasible to grow from $1 billion to $3 billion in AUM within five years?

1Top Performing Firms are those that rank in the top 20% of the Firm Performance Index. The index evaluates all firms in the study according to 15 metrics to arrive at a holistic assessment of each firm’s performance across key business areas. Past performance is not an indicator of future results. 2024 RIA Benchmarking Study from Charles Schwab, fielded January to March 2024. Study contains self-reported data from 1,304 firms. Participant firms represent various sizes and business models categorized into peer groups by AUM.

2Source: https://content.schwab.com/web/retail/public/about-schwab/2024-Charles-Schwab-RIA-Benchmarking-Study.pdf

M&A Market Update

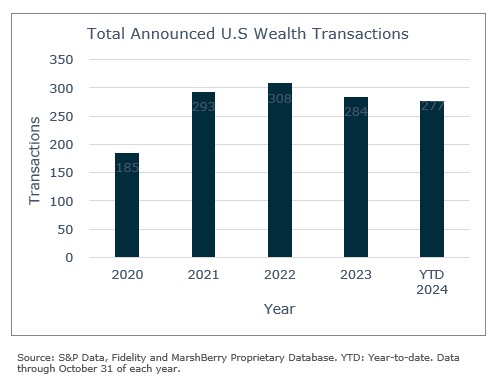

Wealth advisory merger and acquisition (M&A) activity in October 2024 was the strongest month year-to-date (YTD) with 35 announced deals, bringing the YTD count to 277. 2024’s deal count is now only seven deals short of 2023’s total year count (234) and 31 deals short of 2022’s total year count (284). This is a very impressive data point with only two months remaining in the year. There might be a small dip in November activity as historically, November usually sees a lull in deal activity as most acquirers are working to close their deals by year end. As of right now, 2024 appears to be tracking towards a new record setting year.

Whether 2024 becomes the record year or not, MarshBerry’s view remains the same. There continues to be a sustained appetite for quality firms regardless of their size. With two months remaining in the year, which includes the historically high deal count month of December, MarshBerry stands by the optimistic view on continued high deal activity throughout the remainder of the year.

The distribution of buyer types involved in transactions has remained consistent. Private capital-backed buyers continue their hold of the majority market share by accounting for 70% of completed deals through October, or 195 out of 277 transactions. Independent firms represent 22% of deals, while public companies account for the remaining percentage. Although the share of deals by public firms has declined in recent years, these acquisitions tend to be larger in scope. Consequently, the number of public firm acquisitions should be viewed differently. Notably, in 2024, public companies have already acquired more assets through 20 transactions ($273 billion) than they did in 30 deals in 2023 ($121 billion), with $100 billion of the 2024 total attributed to the LPL/Atria Wealth Solutions deal. The main takeaway here is that even if you remove the outlier deal of the year (LPL/Atria), the 2024 assets under management (AUM) still surpasses the prior year deal by over $50 billion.

The top ten buyers represent approximately 31% of all announced transactions through October with 85 of the 277 deals YTD. This means the remaining 192 deals were completed by buyers outside the top serial acquirers. This diversity among the buyers is good for all parties and demonstrates a positive forecast on the strength of the wealth advisory M&A space which is unique to only a few industries.

Once again – Focus Financial Partners, Wealth Enhancement Group, and Waverly Advisors continue to lead the buyer pool, accounting for nearly 13% of the 277 transactions with 13, 12, and 10 deals completed, respectively.

Notable transactions:

October 21: Lido Advisors, a Los Angeles-based registered investment advisor (RIA) with over $24 billion in AUM, announced its merger with Pegasus Partners, a Wisconsin firm managing over $3 billion in AUM. The 22-person Pegasus team will join Lido, with a majority of the team becoming partners under Lido. This merger represents part of Lido’s strategy to expand into the Midwest and enhance its services for ultra-high-net-worth clients. The deal follows a series of acquisitions by Lido, who is backed by private equity firm Charlesbank Capital Partners, which has helped grow Lido’s assets from $9 billion to $19 billion since 2021. Lido’s president, Ken Stern, emphasized the strategic alignment of both firms’ cultures and client-focused missions. This is noteworthy for another reason as well, as this transaction marks Lido’s first deal under its new head of mergers and acquisitions, Henry Hagenbuch.

Looking forward

With the presidential election behind us, the topic of taxes in 2025 can be looked at with more certainty. President-elect Trump made it clear in his pre-election campaign his intention to permanently extend the policies of the Tax Cuts and Jobs Act (TCJA) of 2017, keeping capital gains taxes at current levels, or possibly even lower. While pre-election talk of possible capital gains tax increases may no longer be a concern, it shouldn’t slow deal activity for retirement and wealth advisory firms for the remainder of 2024, and into 2025.

It’s a favorable macroeconomic climate in which interest rates are dropping, and the incoming Republican leadership is promoting stabilized taxes, lower regulations, and pro-business policies. All in all, this is expected to create tailwinds for continued revenue growth and profitability, as well as M&A activity for wealth advisory firms into 2025.

In January 2023, MarshBerry published an article summarizing the Federal Trade Commission’s (FTC) proposed rule that aimed to prohibit the use of non-compete agreements. On April 23, 2024, the FTC finalized the rule, voiding and banning nearly all employee non-compete agreements in the United States. However, there is significant opposition to the rule. In fact, the first lawsuits challenging the rule were filed within hours of the FTC announcing its vote.

Here’s what you need to know about the final rule and what effect it may have on the insurance distribution sector:

What is the background on this issue? On January 19, 2023, the FTC proposed a rule which would make non-compete clauses unlawful. The FTC then accepted and considered over 26,000 public comments on the proposed rule and on April 23, 2024 – 460 days after it was proposed – the FTC’s five Commissioners made it final by a vote of 3-2. The rule will now be published in the Federal Register and is intended to become effective 120 days after publication.

What is the Federal Trade Commission? The FTC was created by act of Congress in 1914 and is charged with preventing entities in the United States from engaging in unfair methods of competition, deemed unlawful by the same Act. The FTC is made up of five Commissioners, who are nominated by the President of the United States and confirmed by the Senate. Commissioners serve a seven-year term and no more than three Commissioners can be from the same political party. The sitting President chooses one Commissioner to Act as Chair. Notably, the Commissioners voted on the non-compete rule along party lines, with the three Democratic Commissioners voting in favor of the rule, and the two Republican Commissioners voting against it.

What specifically is a non-compete clause? The FTC defines a “non-compete clause” as “a term or condition of employment that prohibits a worker from, penalizes a worker for, or functions to prevent a worker from (1) seeking or accepting work in the United States with a different person where such work would begin after the conclusion of the employment that includes the term or condition; or (2) operating a business in the United States after the conclusion of the employment that include the term or condition.” In layman’s terms, non-compete clauses prohibit workers from leaving an employer to work for, or start their own, business that competes with their current employer.

How is the enforceability of non-compete agreements currently handled? Prior to this rule, the enforceability of non-compete clauses was left to individual state law, which varies from state-to-state and undoubtedly leads to legal uncertainty, making compliance burdensome for both employers and workers.

What is the intent of the Non-Compete Clause Rule? The FTC estimates that one in five American workers – or approximately 30 million workers – are subject to a non-compete. In many cases, the FTC believes that non-compete clauses are used by employers to take advantage of their workers and therefore considers non-competes to be contrary to fair competition by reducing workers’ job mobility, limiting competition for workers’ services, and ultimately depriving workers of higher wages and more favorable working conditions.

What does the Rule specifically prohibit? The final rule provides that it is an unfair method of competition for employers to, among other things, enter into non-compete clauses with workers. According to the FTC, this rule amounts to a “comprehensive ban” on all new non-competes with workers. Employers are required to provide written notice to any employees, both current and past, who are covered by non-compete provisions and inform them that those provisions are no longer enforceable.

How does this rule impact the insurance distribution sector? Non-compete agreements manifest themselves in two distinct contexts within the insurance distribution sector:

- In the context of mergers and acquisitions, the principal(s) of an agency that is being sold to a buyer are typically required to agree not to compete with the buyer for certain periods of time, both post-closing of the transaction and after the date the principal’s employment with the buyer comes to an end. Notably, the FTC’s rule does not apply to non-competes entered into pursuant to a bona fide sale of a business entity.

- Second, non-competes exist from time to time in the employment context, most commonly between brokers and their producers and agents. The FTC’s rule does impact non-competes in this context.

The rule contains an exception for non-competes that were entered into before the final rule’s effective date, so long as the person subject to the non-compete qualifies as a “senior executive,” which means he or she must be in a “policy making position” and earn at least $151,164 per year. In turn, the FTC defines a “policy making position” as being the president, chief executive officer, or the equivalent, of an organization. These individuals must have “final authority to make policy decisions that control significant aspects of a business entity and does not include authority limited to advising or exerting influence over such policy decisions.” Very few individuals within an agency will qualify for this exception. Even some who hold ownership stakes may not qualify under the exception.

However, the rule itself is limited to non-compete clauses. It does not prohibit non-disclosure/confidentiality or non-solicitation agreements, nor does it prohibit reasonably drafted non-piracy and non-acceptance provisions, which tend to be more common in the insurance brokerage sector. Generally speaking, these provisions are narrower in scope and therefore more likely to be considered enforceable because they are designed to protect legitimate business interests as opposed to preventing employees from earning a living.

What’s Next?

There will be significant opposition to the FTC’s proposed rule. Arguments against the rule center on whether the FTC has the requisite authority to promulgate such a rule or whether issues such as this should be left to Congress to decide. As the old saying goes, the wheels of justice turn slowly and we can expect it to be years before this issue is finally decided, perhaps by the United States Supreme Court.

Key takeaways from the FTC rule on non-competes:

- Absent some other action, such as a court-imposed injunction, the rule is set to become effective 120 days after it is published in the Federal Register, which will likely be late summer or early fall 2024.

- The rule is meant to be a comprehensive ban on non-competes and only has three distinct exceptions, including the bona fide sale of a business.

- For non-competes that are currently in place, or are put in place prior to the effective date of the rule, to remain enforceable, the person subject to them must qualify as a “senior executive.” This means they are required to meet a certain earnings threshold, but also “have final authority to make policy decisions that control significant aspects of a business entity and does not include authority limited to advising or exerting influence over such policy decisions.” This is a very narrow standard and would largely render void most non-competes between agencies and producers/staff.

- Non-compete clauses that are put in place after the effective date of the rule are void regardless of one’s ownership or status as a “senior executive.”

- The rule does not apply to non-competes that arise in the context of the bona fide sale of a business and are entered into between owner(s) of the selling business (regardless of ownership percentage) and a buyer.

- The rule does not apply to confidentiality/non-disclosure, non-solicitation, non-piracy, and non-acceptance clauses that are common in the insurance space.

- There is significant opposition to the FTC’s rule. It may take years for the issue to be resolved.

Investment banking services in the USA offered through MarshBerry Capital, LLC, Member FINRA and SIPC, and an affiliate of Marsh, Berry & Company, LLC, 28601 Chagrin Blvd, Suite 400, Woodmere, OH 44122 (440) 354-3230